June 2021

Author Thanh Duy Tran, Senior Partner at Kloepfel Consulting

The importance of purchasing for functioning companies is currently made clear to medium-sized entrepreneurs once again. A wide variety of manufacturing industries are complaining about supply bottlenecks and lunar prices. Steel, aluminum, copper, plastics, electronics, electrical components and even purchased parts are causing headaches for many SMEs. Security of supply is the number one issue in many companies. Purchasing develops from being the ordering department to being the savior of production, opening up both profit-taking and new opportunities for growth.

Read in this article how buyers master the current market situation in the short and long term. And learn how management can support their buyers.

The current market situation: Strengthening economy leads to bottlenecks

Steel prices have doubled on average within a year, and delivery times have risen from four to six weeks up to six months in some cases. Anyone who needs steel in early 2022 must order it today. Copper is at an all-time high. And many other material groups are also experiencing massive price increases in some cases, as well as accompanying or preceding delivery problems.

The causes are widely known. Trade conflicts, the Brexit and especially the pandemic caused pessimistic economic forecasts. All these developments prompted companies to reduce inventories, cut production capacity, introduce short-time working and in some cases even to cut staff.

But then came the surprisingly rapid recovery of the economies in Europe, the USA and Asia. Now that companies are ramping up production again, demand for materials and skilled workers is rising sharply. In many areas, seller’s markets have emerged with supply bottlenecks and price explosions affecting the entire value chain. In addition, there is the carabiner effect. If a supplier cannot deliver a small but important component, the costumer’s production stops. Entire supply and value chains are disrupted. Based on our many discussions with customers and suppliers, we do not expect the situation to ease in many sectors until around the end of 2021 or beginning of 2022. According to a survey conducted in June 2021, many BME members even expect bottlenecks to persist until the end of 2022.

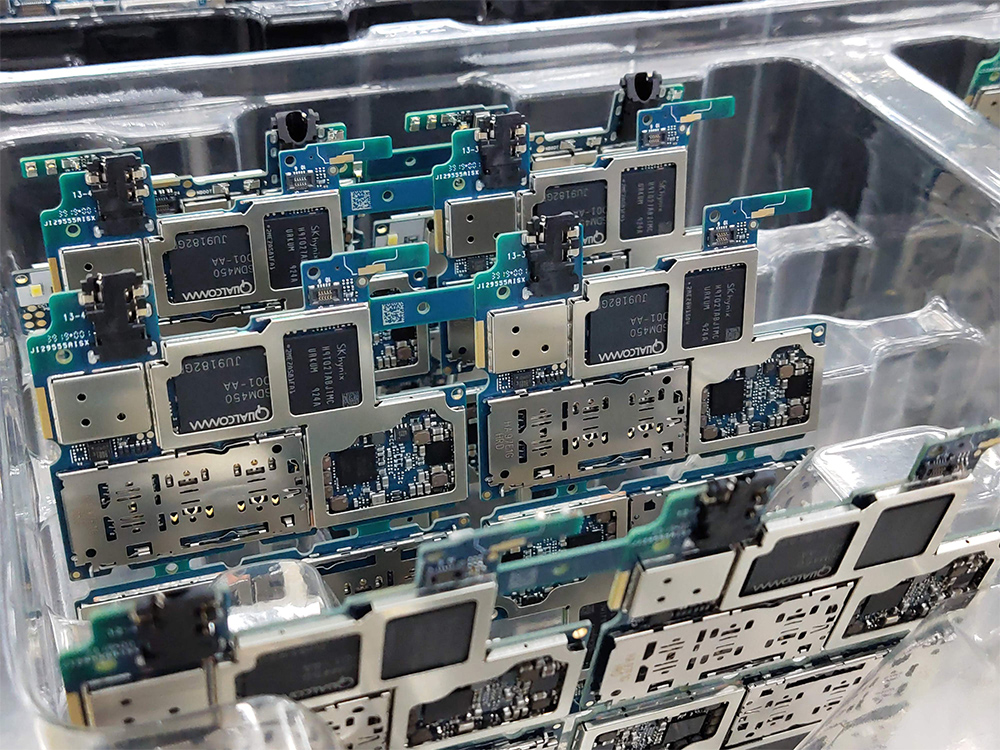

Supply problems for electrical and electronic components will be exacerbated by increasing digitization and automation as well as the electric car boom. This will result in longer delivery times for e-cars, charging stations and even white goods such as refrigerators and ovens. On top of that, a massive cold snap last winter in Texas led to production losses at major semiconductor producers.

Winners and losers

One lacks material, the other lacks orders. For example, aircraft, airport equipment and streetcars are being used less and so their manufacturers as well as the corresponding suppliers are experiencing problems. Aircraft manufacturer Airbus does not expect to recover until 2024. The hotel, catering and tourism industries have been hit just as hard. Other sectors are already above pre-crisis levels. The biotech sector, the medical industry, hospital suppliers, food delivery services, online retailing and related industries such as logistics, intralogistics, pallet and packaging manufacturers are emerging from the crisis as winners. The call for more climate protection in turn promotes sustainable products, for example, in wood-processing industries or the e-mobility sector.

Firefighting: What buyers can do in the short term

Creative purchasing: Finding alternative sources of supply

Tap alternative suppliers, investigate hidden overcapacities in the market, request networks of associations and purchasing consultants across industries. Although automotive and mechanical engineering, for example, have different characteristics, they can sometimes use the same suppliers to their advantage. Some manufacturers supply not only automotive series customers, but also special vehicle construction or general mechanical engineering. If companies in weakening sectors are doing badly, it may well be that their suppliers have unrecognized overcapacities from which SMEs in flourishing sectors can benefit. That’s why it’s also worth making broad inquiries and networking to find out who knows which suppliers and which traders for which material groups.

Our experience shows that many suppliers and technical distributors around the globe are interesting in bridging supply shortages. Industries recover differently in different countries around the world. Therefore, certain raw materials or components are less in demand in one country than in others and are therefore cheaper or more available. That is why it is worth looking at other European countries or Asia. There are many stocks internationally that you would not expect to find, but which can be tracked down through digital global sourcing.

Database with thousands of qualified suppliers

Kloepfel Consulting can also support you in these cross-country and cross-industry explorations. The purchasing and supply chain specialists have qualified thousands of suppliers worldwide since 2007. A call to +49 211 875 453 23 or an e-mail to rendite@kloepfel-consulting.com is all it takes and we will put you in touch with our specialists at short notice, who will give you solid information on how supply bottlenecks can be eliminated and price increases averted for specific material groups.

Assemble with construction

Easy and uncomplicated modifications of your own or supplied components, help to increase your compatibility with other components to close supply bottlenecks or counter price explosions. It is therefore always worthwhile for purchasing to sit down with the design department and suppliers to discuss modifications with little effort. Our field-tested colleagues from Kloepfel Engineering help purchasers to conduct workshops with the design engineers and suppliers in order to optimize project purchasing, for example by modifying components.

Value creators: How purchasers can shine in the medium and long term

Maintain supplier relationships systematically

If suppliers fall through a tender, for example, that’s no reason to stop contact completely. They may find your alternative suppliers today among the last best performers of past tenders that only narrowly lost the tender. Buyers who look after (potential) suppliers closely and treat them well are much less likely to complain about delivery problems. This includes, for example, punctual payment or constructive cooperation on solutions.

The Purchasing knows this too, but it often has too little time for sufficient supplier management. An average mechanical engineering company has about 1,000 to 1,500 suppliers, but only three to ten buyers. Many companies therefore integrate external purchasing specialists such as those from Kloepfel Consulting as temporary colleagues.

In the course of a project, companies then recognize the true potential of their buyers and ensure that they are strengthened in the long term. For example, by increasing the number of departments, promoting digitization, outsourcing simple, non-value-added activities such as invoice audits, or automating and streamlining C-parts purchasing. Purchasing thus gains valuable time for its supplier contacts.

Product changes

We have already addressed the issue of compatibility: Purchased parts or proprietary products can certainly be modified to make components more compatible in order to bridge supply bottlenecks. The same applies to substitutes: There are many raw materials that can be replaced by other (synthetic) materials. Material efficiency: German companies could produce in a more material-efficient way. In other words: The less waste, the more recycling, the more moderate use of energy, the less stock or the better selection of materials.

In addition, it is advisable to simplify non-USP products that do not require core know-how and to use already available “out of the shelf” components. If you standardize and simplify special designs, you are less dependent on special manufacturers or special suppliers, which in turn gives companies major competitive advantages and reduces delivery risks. This is especially true when standard solutions have long been available on the market, which can be purchased and used as “optional part numbers” from several suppliers. This increases flexibility and availability many times over, which ultimately leads to the best possible prices regardless of the market situation.

Recognizing favorable purchase prices

Continuous market observation helps to identify developments as early as possible. Purchasing often lacks the time to do this. Here, too, Kloepfel Consulting can relieve purchasing managers through digital tools and outsourcing.

Optimize purchasing in weaker phases

Use quieter periods to simplify or standardize products, train employees, introduce digital tools, build alternative suppliers, cultivate networks, outsource non-value-added activities and optimize processes.

All of these actions will make you more resilient and put you in a better competitive position.

Arrange a phone consultation on supply shortages and price explosions!

Thanh Duy Tran

Senior Partner at Kloepfel Consulting

Phone: +49 211 875 453 23

E-mail: rendite@kloepfel-consulting.com