Transaction background

The individual enterprise of Arnd Brüning, founded in 1992 in Fischerhude near Bremen, presents itself today as the Brüning Group with the companies Brüning-Euromulch GmbH, Brüning-Megawatt GmbH, Brüning-Logistik GmbH, Brüning International GmbH and Gebrüder Meyer GmbH. Since then the group developed to a service enterprise operating European-wide and is established among other things as a market leader with the supply of biomass (heat) power stations. Positioned as a supply and disposal company, the Brüning Group structures and bundles the flow of mainly woody raw materials for thermal and material recycling (e.g. to energy producers, wood-processing industry, gardeners and landscapers).

The Brüning Group is characterized on the one hand by a comprehensive and unique product portfolio of mulch and bark products, pellets, wood chips, sawdust and waste wood, and on the other hand by reliable supply and disposal to its customers and suppliers, supported by its own logistics. Thanks to its long-term experience and even stronger cross-regional orientation in the future, it can react quickly and efficiently to market changes. In addition, as an intermediary in a highly fragmented market for both suppliers and customers, its size and reach beyond Germany makes it one of the few market players that is able to meet demand regardless of volume, season, weather or geography. As a result, the company exceeded the turnover threshold of 90 million euros in 2018.

In 2017, the former sole shareholder and CEO of the group, Arnd Brüning, began to think about the future of his company. He thus developed a vision that aims to secure the long-term independence of the company he founded and lifts its successful development to the next level – together with a sparring partner.

Approach of Kloepfel Corporate Finance

While searching for the right sparring partner who not only shares Arnd Brüning’s vision of the future, but also fits in culturally with the company, Kloepfel Corporate Finance (KCF) was invited to pitch the sales mandate.

In addition to process know-how and excellent market knowledge regarding potential buyers, key factors in selecting an M&A advisor are the ability to speak the language of the entrepreneur and potential investors as well as the chemistry between the people involved. In a competitive selection process, however, KCF was able to convince the shareholder and was appointed as the exclusive M&A advisor for the sale process.

Thus, intensive cooperation with the company’s management team, which was involved in this transaction, began in the second quarter of 2018. After several meetings in which Brüning explained its business model and long-term strategy for the company’s growth and the characteristics of the potential target companies, KCF prepared all the key materials showing the Group’s historical performance and strong platform for growth opportunities. At the same time, KCF began to analyses the international market for potential investors on the basis of the Brüning Group’s criteria, to find not only the right partner for the shareholder, who shares its vision, but who also accompanies and supports the company’s further international organic and inorganic growth path. An extensive list of private equity houses as well as strategic potential buyers was drawn up and discussed with the company. It was agreed to set up an internationally structured selective marketing process that includes both selected private equity houses and selective strategic prospective buyers. The next step was to identify potential buyers. The convincing and sophisticated business model of the Brüning Group, the established market position as well as the long-term growth potential of the Group in combination with the management performance and future vision of Arnd Brüning and his management team supported the receipt of several indicative offers from both strategic prospective buyers and financial investors.

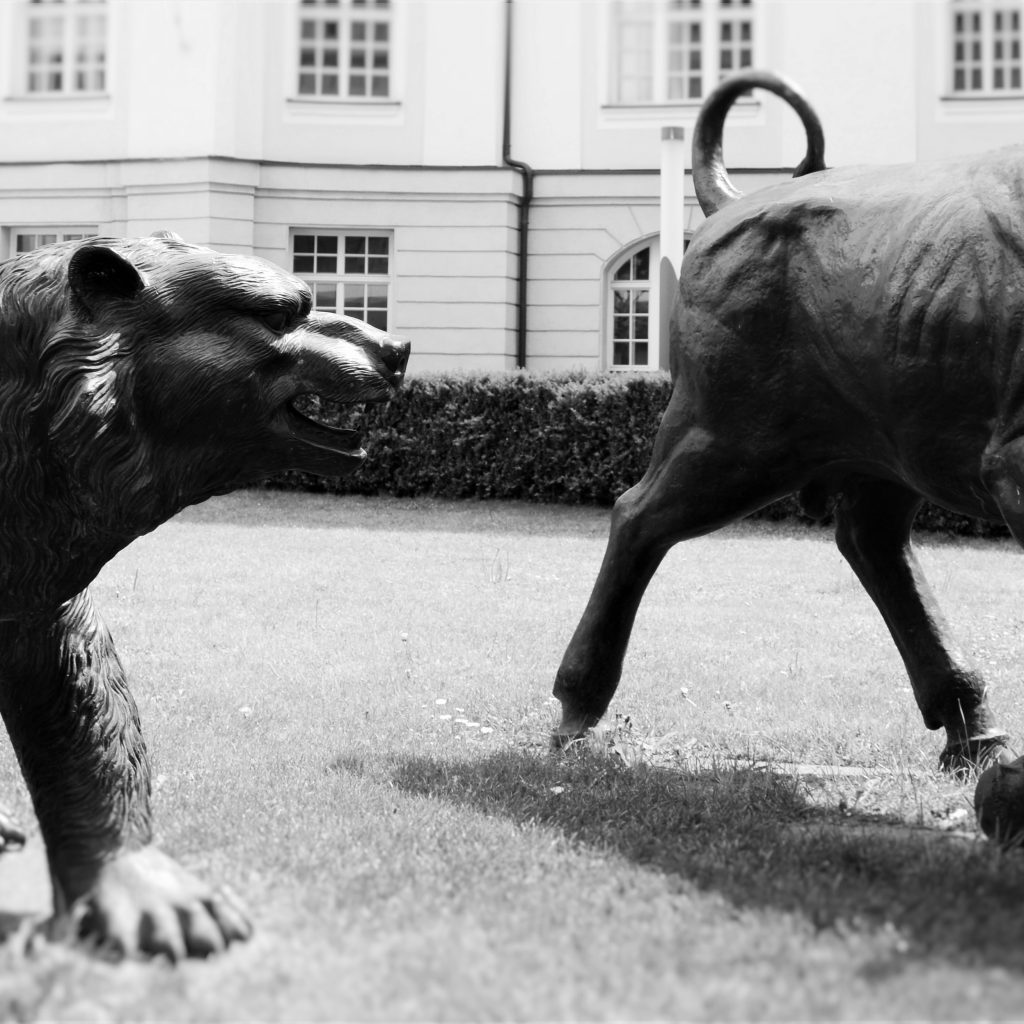

From this starting position, KCF then created a competitive environment, which not only increased the value of the company, but also led to prospective buyers approaching the shareholder with various investment scenarios. The shareholder Arnd Brüning was not only allowed to make a decision on the basis of the commercial side, but could also decide on a participation structure corresponding best to his personal needs.

Arnd Brüning finally opted for a strategic partnership with financial investors by selling a significant minority stake in CIC Capital, the international direct investment company of the Crédit Mutuel Group, and PESCA Equity Partners as part of an owner buy-out. With the addition of the two equity investors, Arnd Brüning remains the majority shareholder, but acquired two partners with both the financial resources and the network to develop the Group’s organic and external growth.

Arnd Brüning stressed: “With CIC Capital and PESCA Equity Partners we have found strong partners for the future of our company who will accompany and actively support us on our growth course. Our initial discussions have already shown that our views on the strategic direction of the company are in agreement and that the chemistry between the people involved is right. I look forward to the cooperation and strategic dialogue with our new partners”.

Further information on Kloepfel Corporate Finance can be found here!