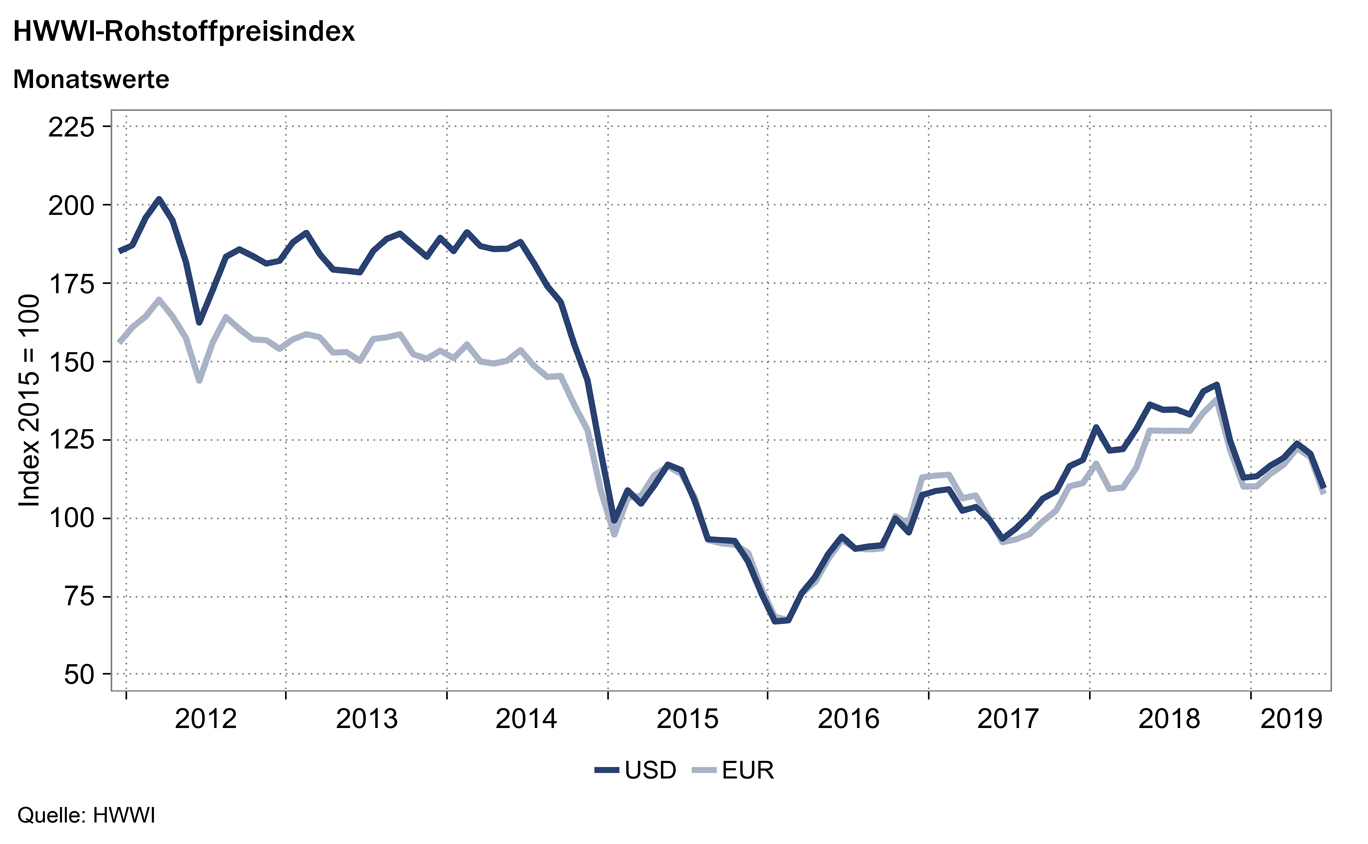

HWWI raw material price index falls further in June

- HWWI total index falls by 9.1% (US dollar basis)

- Crude oil price decreases by 10.6%

- Index for non-ferrous metals drops by 1.6%

Hamburg, 17 July 2019: The HWWI commodity price index fell by an average of 9.1% (in euros: -10.0%) in June compared with the previous month. Thus, the overall index achieved a score of 109.5 points (in euros: 107.6 points). While the prices of all commodity groups represented in the index fell in May, the prices of fossil energy raw materials in particular fell in June. The index for energy raw materials fell by 10.9 % (in euros: -11.7 %), with crude oil falling by 10.6 % (in euros: -11.4 %) on a monthly average. A significant price increase could be seen for raw materials of the food and beverages group. The index for food and beverages rose by 6.9 % in June (in euros: +5.9 %). By contrast, the increase in industrial raw materials was less noticeable at 1.8 % (in euros: +0.9 %), while the index for nonferrous metals fell by 1.6 % (in euros: -2.5 %). Prices on the raw material markets continued to be determined under great uncertainty in June. The OPEC+ meeting scheduled for 25 June 2019 was postponed until early July in order to await the results of the G20 meeting in Osaka. Once again, the conflict between the USA and Iran intensified. In addition, the trade conflict between China and the USA continued to have a negative impact on prices on the commodity markets. The index excluding energy rose in June by 3.5 % (in euros: +2.5 %) compared to the previous month and is quoted at 112.5 points (in euros: 110.6 points).

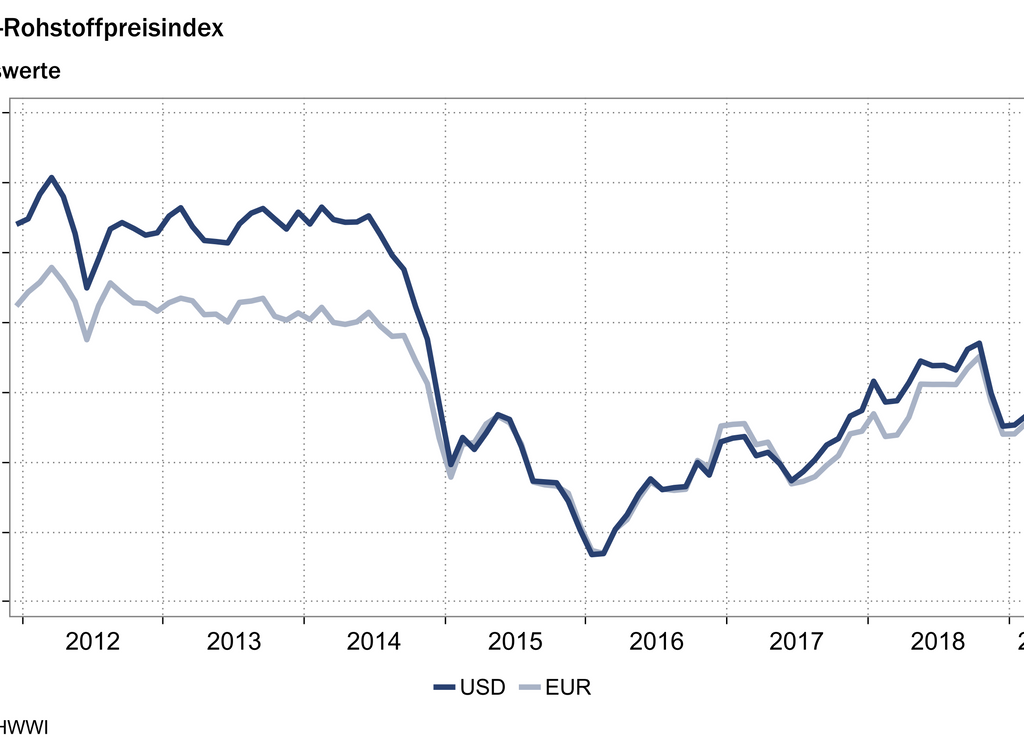

Index for energy raw materials: -10.9 % (in euros: -11.7 %)

Crude oil prices fell on average by -10.6% (in euros: -11.4%) to 59.85 US dollars (52.99 euros) per barrel. The prices of all three types of crude oil represented in the index fell, with crude oil from the Middle East falling most sharply. Geopolitical and economic uncertainty determined prices on the crude oil markets and led to falling prices in June. The escalation of the conflict between the USA and Iran only led to slightly rising prices in the short term. Pessimistic expectations of demand due to concerns about the global economy led to a significant drop in crude oil prices in June. The monthly average price for Dubai crude oil from the Middle East fell by 11.5 % (in euros: -12.3 %) compared with the previous month. The second sharpest fall was in the price of Brent crude oil from Europe. On a monthly average, Brent fell by -10.3 % (in euros: -11.2 %). The weakest fall was in the price of US crude oil. The WTI grade fell by 9.9% (in euros: -10.8%).

The average price of natural gas fell by 12.2 % (in euros: -13.1 %), whereby the price of European natural gas fell particularly once again. The monthly average price of European natural gas fell by 15.4 % (in euros: -16.1 %), which was even more pronounced than in May. The ongoing Crimean conflict is weighing on economic relations between Russia and the USA and thus on price developments in Europe. With a high global supply and lower demand, US natural gas is pushing its way into the European market. US natural gas also became cheaper, but only by 10.2 % (in euros: -11.1 %). In addition, the price of coal fell. Coal became 14.0% cheaper (in euros: -14.8%). In June, the index for energy raw materials fell by 10.9 % (in euros: -11.7 %) to 109.0 points (in euros: 107.1 points).

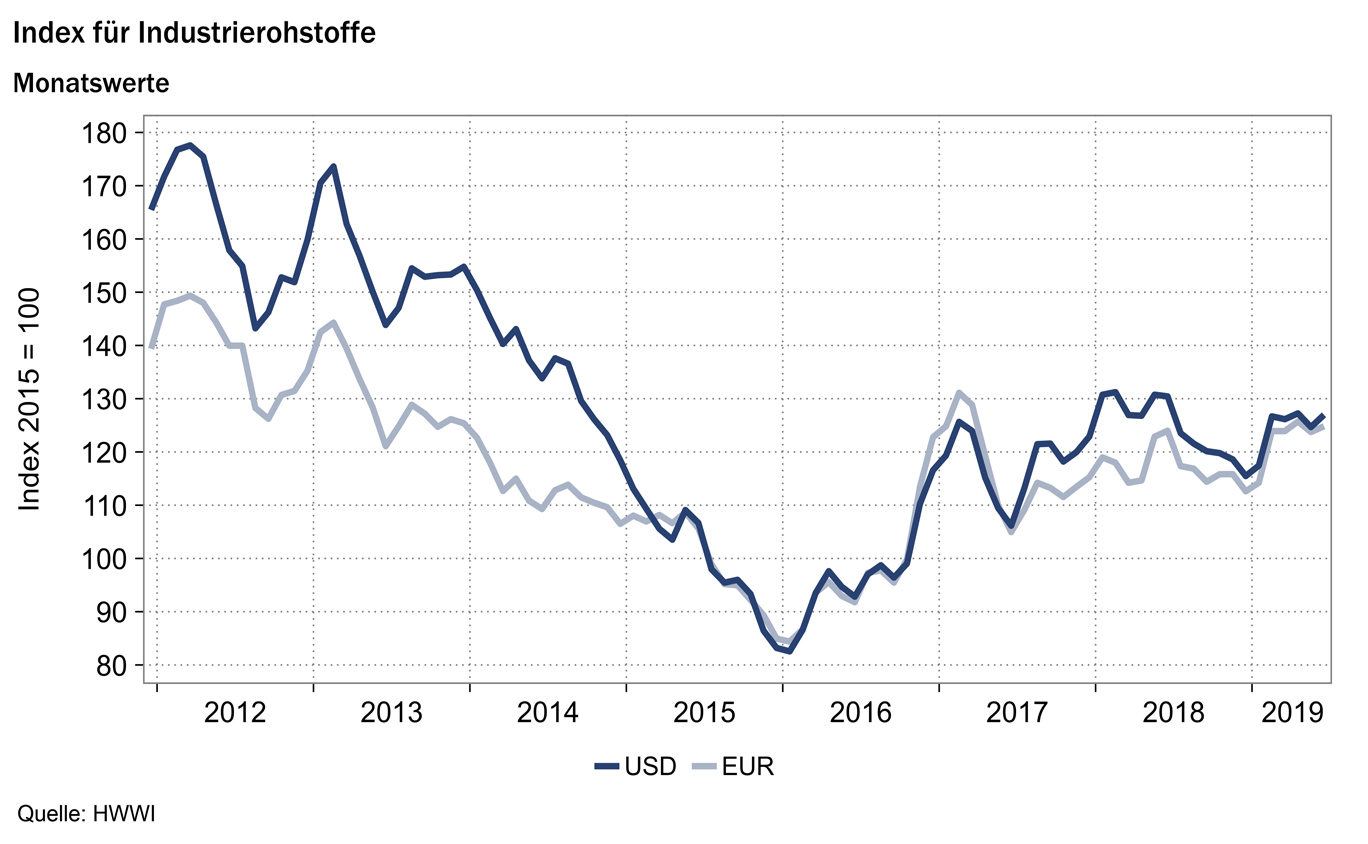

Index for industrial raw materials: +1.8 % (in euros: +0.9 %)

The index for industrial raw materials is divided into the index for agricultural raw materials, the index for non-ferrous metals and the index for iron ore and steel scrap. The index for agricultural raw materials rose (in euros: fell) moderately by 0.4% (in euros: -0.5%) in June. The price of hides and skins fell again in June, but less sharply than in May. In concrete terms, animal hides fell in price by an average of 12.0 % (in euros: -12.9 %). Ethical concerns about using this raw material in textile production and falling Chinese demand due to import duties continue to weigh on the demand side. Cotton and wool prices also fell. The prices of both raw materials fell by 5.3 % each (in euros: -6.2 %). The index for non-ferrous metals fell by 1.6% (in euros: -2.5%). With the exception of lead, the monthly average prices of all non-ferrous metals included in the index fell. Rising output in China, high inventories and low demand caused the zinc price to fall most sharply. The zinc price fell by 5.3 % (in euros: -6.1 %). The price of copper fell by 2.5 % (in euros: -3.4 %). Nickel fell by -0.2% (in euros: -1.1%) and tin by -1.9% (in euros: -2.8%). Aluminum prices fell by 1.1% (in euros: -2.0%). The price of lead rose by 4.1% (in euros: 3.1%). The index for iron ore and steel scrap rose again, with an increase of 6.7 % (in euros: +5.6 %), which is more pronounced than in the previous month. The index for industrial raw materials rose in June by 1.8 % (in euros: +0.9 %) to 127.1 points (in euros: 125.0 points).

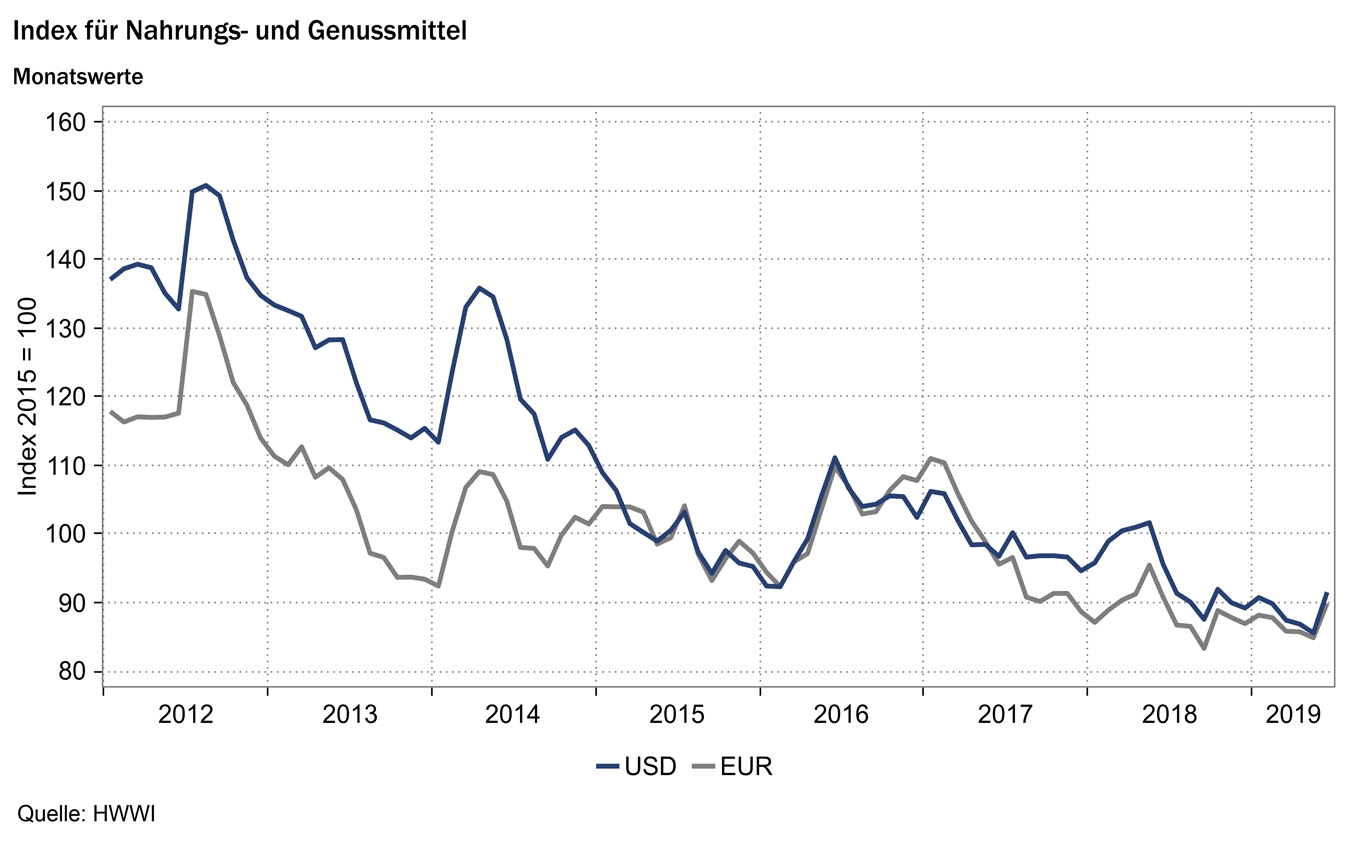

Index for food and beverages: +6.9 % (in euros: +5.9 %)

In June, rising prices for food and stimulants were observed for the most part. The strongest price increase was recorded for corn. Bad weather during sowing reduces harvest expectations. The price of corn rose by 15.1% (in euros: +14.0%). Deterioration in harvest results due to poor weather conditions for wheat is also expected. The wheat price rose by 10.8 % (in euros: +9.8 %). The barley price rose by 9.6 % (in euros: +8.5 %). Prices for soybeans and soy meal also rose. The price of soybeans rose by 7.6 % (in euros: +6.6 %) and the price of soy meal rose by 7.0 % (in euros: +6.0 %). An increase of the demand and cold weather in the main cultivation area Brazil let the coffee price increase by 7,3% (in euros: +6.3%). The price of sugar also rose. Low inventories and weak precipitation in India are weighing on the supply side.

At the same time, expectations of demand are rising as Brazil continues to push ahead with the production of ethanol from sugar cane for biofuel. Sugar prices rose by 5.4 % (in euros: +4.4 %). After the tea price rose in May, the price of tea fell by 5.1% in June (in euros: -5.9%). Overall, the index for food and beverages rose by 6.9 % (in euros: +5.9 %) to 91.5 points (in euros: 89.9 points).