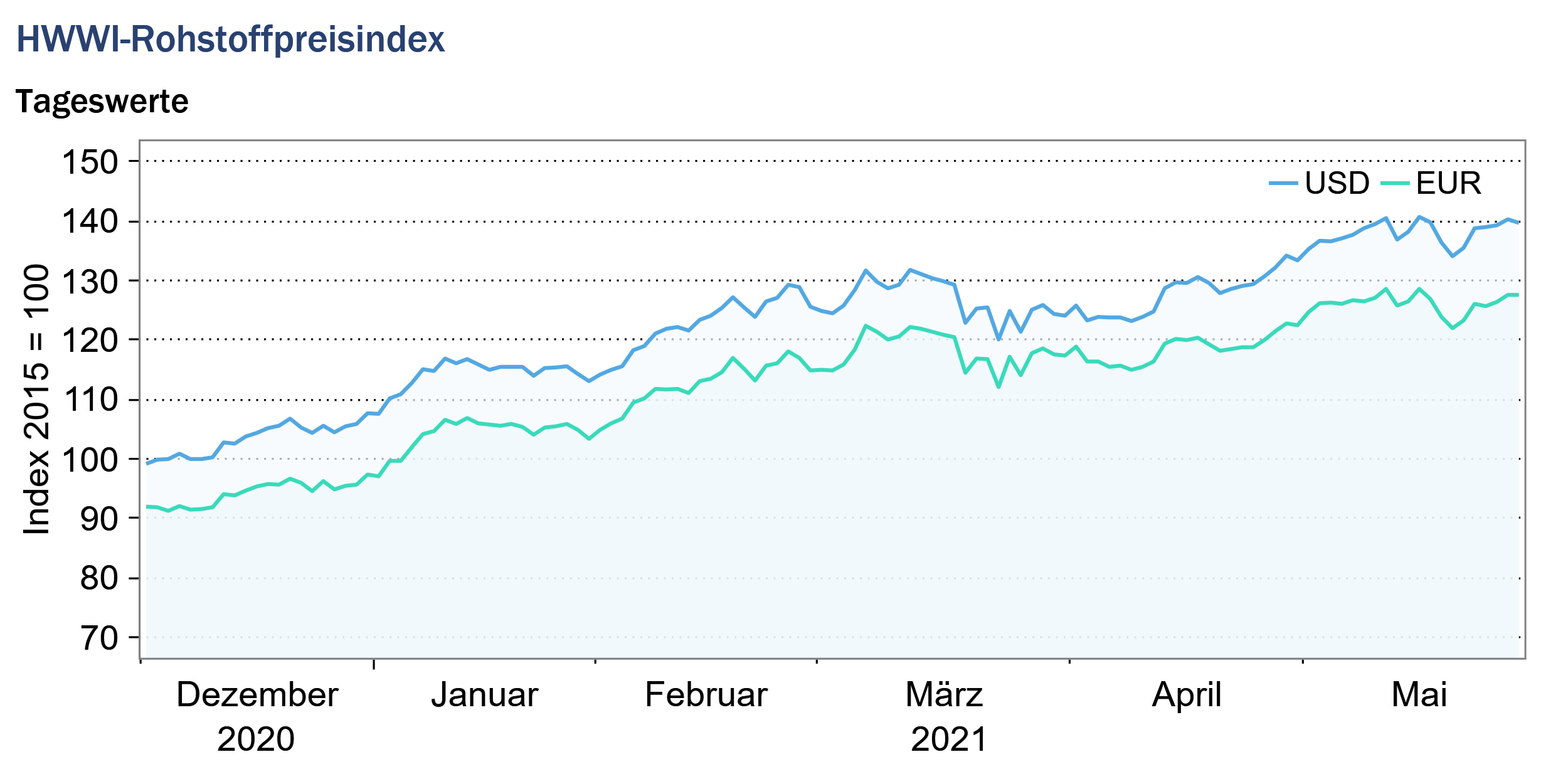

HWWI Commodity Price Index increases further in May

- HWWI overall index rose by 8 % (US dollar basis)

- Crude oil prices increased by 4.8 %

- Sawn wood prices rose by another 33 %

(Hamburg, June 4, 2021) The HWWI Commodity Price Index rose by an average of 8% in May compared to the previous month and exceeded the corresponding value of the previous year by 111%. The rapid recovery of the global economy and particularly thestrong upward trend of the Chinese economy are currently ensuring high demand for commodities. As a result, price increases were observed in almost every major commodity market in May and all three sub-indices for energy commodities, industrial commodities and food and beverages increased compared to the previous month. Prices for industrial raw materials rose particularly strongly in May, as high global demand, especially from China, met with continued limited supply.

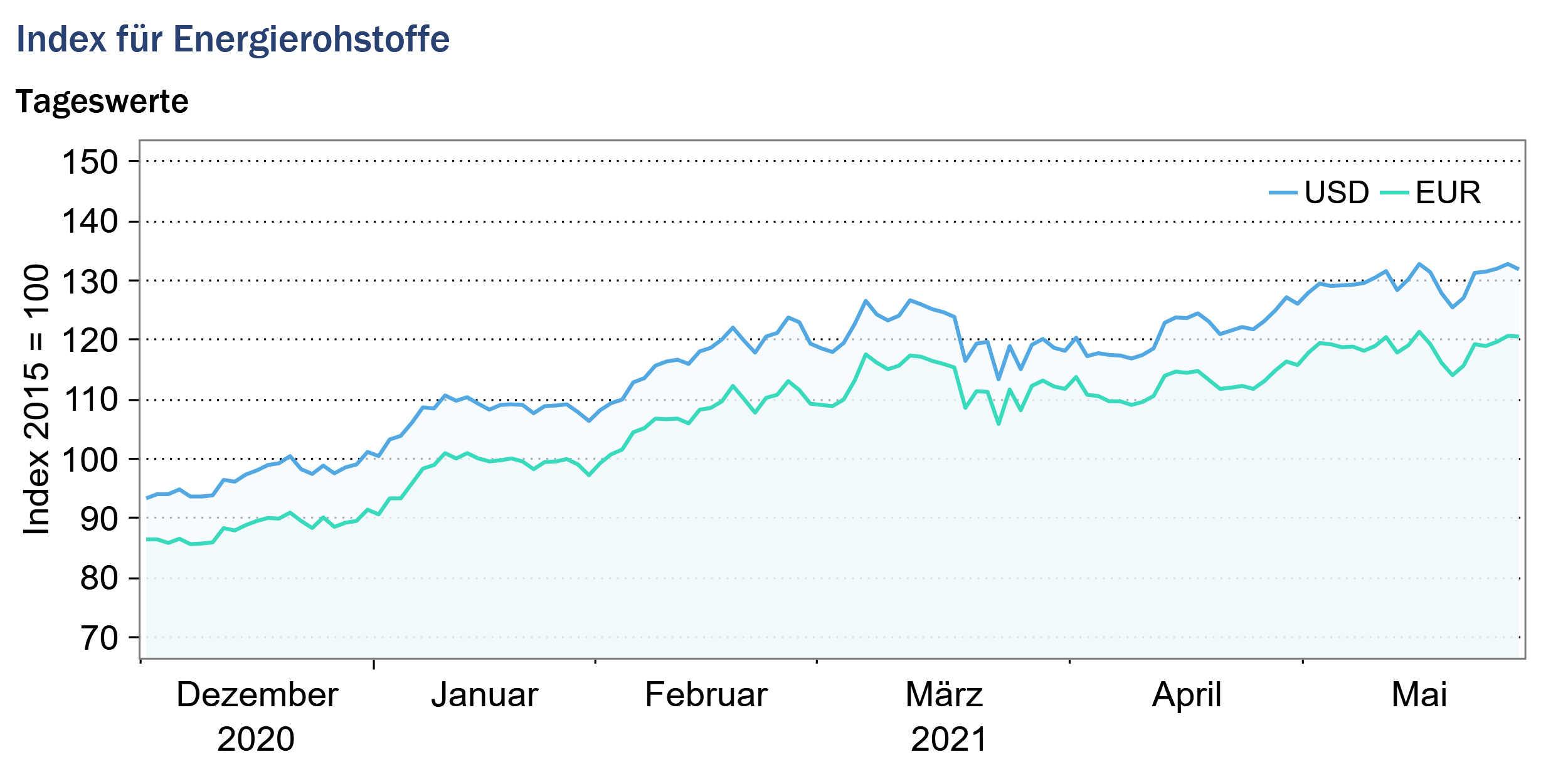

Index for energy raw materials: +7.2 % (euro basis: +5.6 %)

Progressing vaccinations, especially in the USA and Europe, also raised hopes in May of an early end to the pandemic and thus of a final easing of the lockdown measures imposed worldwide. In response to the positive economic outlook and the associated expectation of an increase in crude oil demand, crude oil prices continued to rise in May, exceeding pre-crisis levels by the end of the month. In addition to the recovery of global industry, the easing of the lockdown measures is also expected to boost international tourism, which would also result in an increase in demand for crude oil. European Brent crude oil reached US$70 per barrel at the end of the month, a level not surpassed since the beginning of 2019.

However, the rise in crude oil prices continues to be dampened by uncertainty about the development of the Corona pandemic in India, a major importer of crude oil, and concerns about further virus mutations. On the supply side, the current negotiations between the US and Iran regarding Iran’s nuclear program bring uncertainty to the markets. In case of an agreement and a lifting of sanctions, an increase in Iranian crude oil supply could be expected again in the future. Since May, OPEC+ has been gradually bringing more crude oil onto the market as planned but continues to monitor developments on the crude oil markets in order to adjust if necessary.

Strong price increases were also seen in the coal markets in May. Both South African and Australian coal prices increased on average in May compared to the previous month, with Australian coal prices increasing by 7 % and South African coal prices by as much as 9 %. The increase in the coal markets is partly due to continued strong demand from Asian countries, especially China. In addition, supply shortages due to production interruptions in Australian mines reinforced the price upswing.

The American and European natural gas prices continued to increase strongly in May compared to the previous month. While the American natural gas price rose by 10 % on average for the month, the price of European natural gas increased by 30 % compared to the previous month.

Overall, the energy raw materials sub-index rose by 7.2 % (euro basis: 5.6 %) to 130.1 points(euro basis:118.9 points).

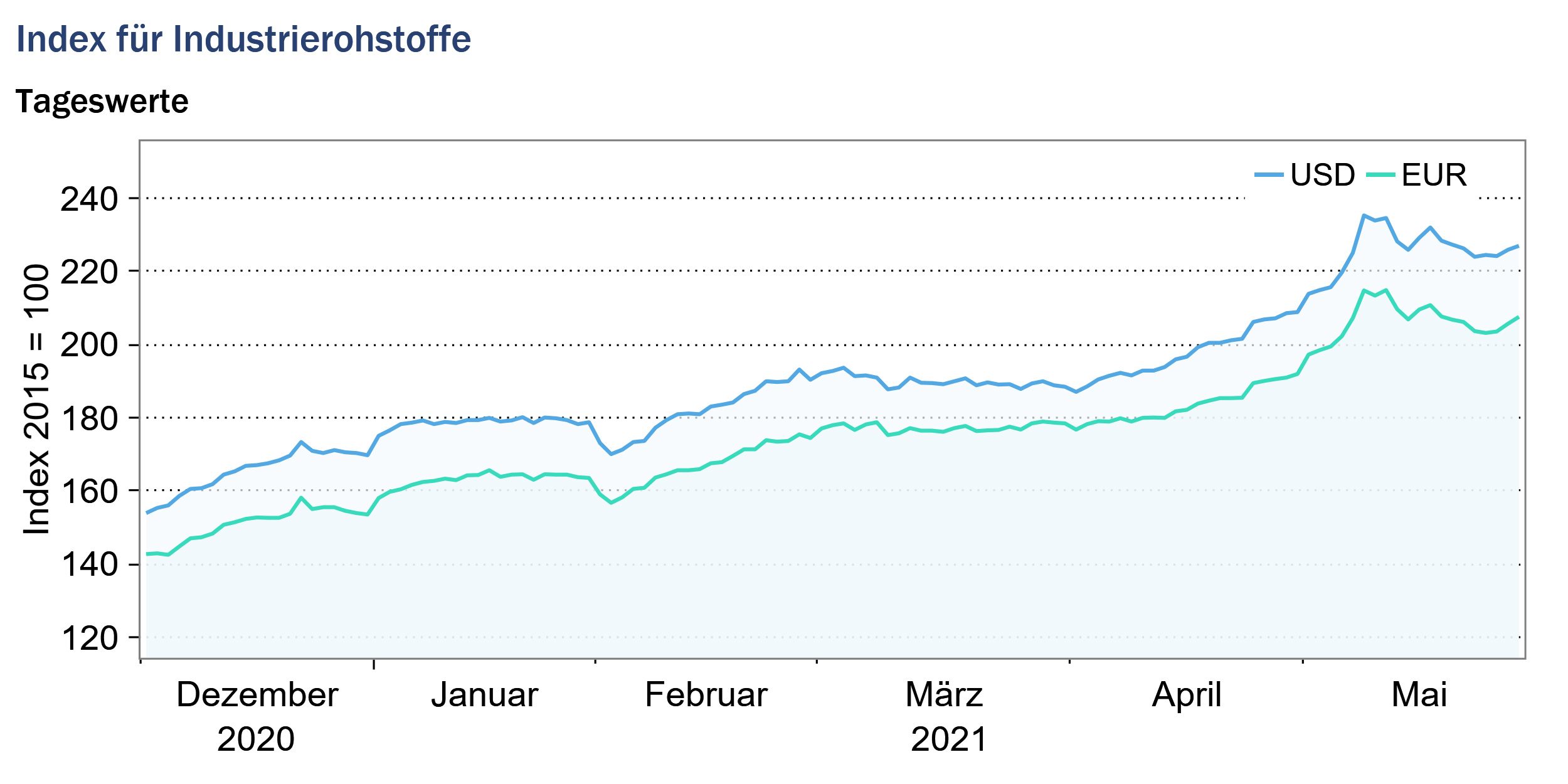

Index for industrial raw materials: +14.2 % (euro basis: +12.5 %)

The industrial commodities sub-index is divided into the agricultural commodities index, the non-ferrous metals index and the iron ore and steel scrap index. All three sub-indices continued to record strong price increases in May, reflecting the economic recovery after the sharp decline due to the Corona pandemic.

The non-ferrous metals sub-index rose by an average of 7.5% in May compared to the previous month, driven particularly by price increases in the tin, nickel, copper and lead markets. The tin price, which rose by an average of 14.4 % in May compared to the previous month, exceeded its 10-year high at the end of the month. The positive price development is driven by demand from consumer electronics, which was even supported by the pandemic. Due to the increase in remote working and homeschooling during the pandemic, demand for smartphones, laptops and iPads has surged. In addition, some tin production plants in China’s Yunnan province had to close in May due to drought and the resulting lack of hydropower, which led to a shortage in the supply of tin.

The current global economic upswing, especially in China, is clearly noticeable in the demand for industrial metals. The price of copper, for example, which is an important economic indicator, rose sharply in May. China is the world’s largest consumer of copper, consuming half of global production. The electrification of the economy as part of the drive towards decarbonization, reinforced in part by the current stimulus packages, is also currently driving demand for some industrial metals such as copper and nickel.

The iron ore markets also saw high price increases in May compared to the previous month. The price of iron ore rose by almost 19% on average for the month and was 130% higher than in May 2020, thus also reflecting the rapid economic upswing. Especially in China, steel production was ramped up strongly last month.

Pulpwood and sawn wood prices continued their positive trend in May. Sawn wood prices in particular reached record highs. On average, sawn wood prices rose by a further 33 % compared to April and were thus more than 340 % higher than in May 2020. Sawn wood prices continue to be driven by a huge increase in demand in the wake of the economic recovery. The stimulus packages launched around the world are also supporting demand. The supply difficulties and high prices are clearly felt by consumers.

Overall, the index for industrial raw materials rose by a monthly average of 14.2 % (eurobasis: 12.5 %) to 225.9 points (euro basis:206.5points).

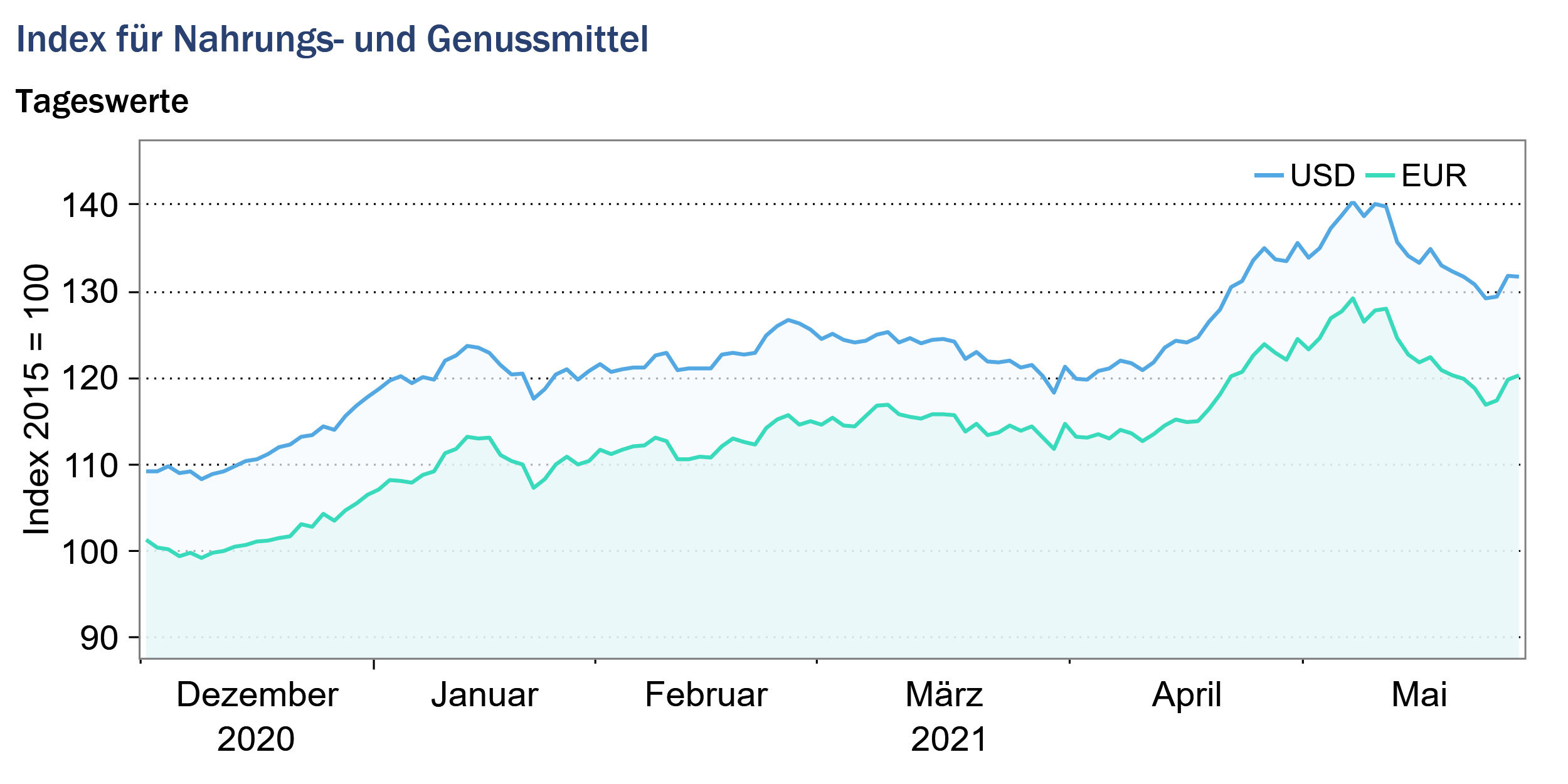

Index for food and beverages: +6.5 % (euro basis: +5.0 %)

The index for food and beverages rose by an average of 6.5 % in May compared to the previous month, with all three sub-indices included in the index recording price increases.

The sub-index that tracks price developments in the grain markets rose particularly strongly. Strong demand from China continued to drive prices for corn, barley, and wheat. In addition, poor harvest forecasts due to unfavorable weather conditions caused supply shortages. Cornprices recorded an average increase of almost 13 % compared to the previous month and were 118 % higher than in the corresponding month of the previous year. However, at the end of the month, the upwardly revised production outlook in the USA caused corn prices to fall again.

The sub-index for oils and oilseeds also increased on average compared to the previous month due to price increases in the soybean, soybean oil, palm oil and coconut oil markets. Prices for vegetable oils continue to be supported by robust demand, especially from the biofuel sector. In addition, the La Niña weather phenomenon in palm and soybean growing areas is affecting the harvest and reducing supply.

The increase in the luxury food sub-index reflects the sharp price increase in the coffee markets. The continuing drought in Brazil’s main coffee-growing regions worsened crop forecasts and significantly tightened supply on world markets. In addition, road and port blockades triggered by riots in Colombia affected the transport of Colombian coffee, which also reduced coffee supply in May. Furthermore, the coffee price was supported by the demand side. Vaccination progress in the USA and Europe, as well as the gradual easing of the lockdown measures, point to an increase in coffee demand. In particular, out-of-home consumption in cafés and restaurants had plummeted due to the lockdown measures to combat the pandemic.

Overall, the food and beverages index rose by a monthly average of 6.5 % (euro basis: 5.0%) and stood at 134.5 points (euro basis: 122.8 points).

Source: www.hwwi.org