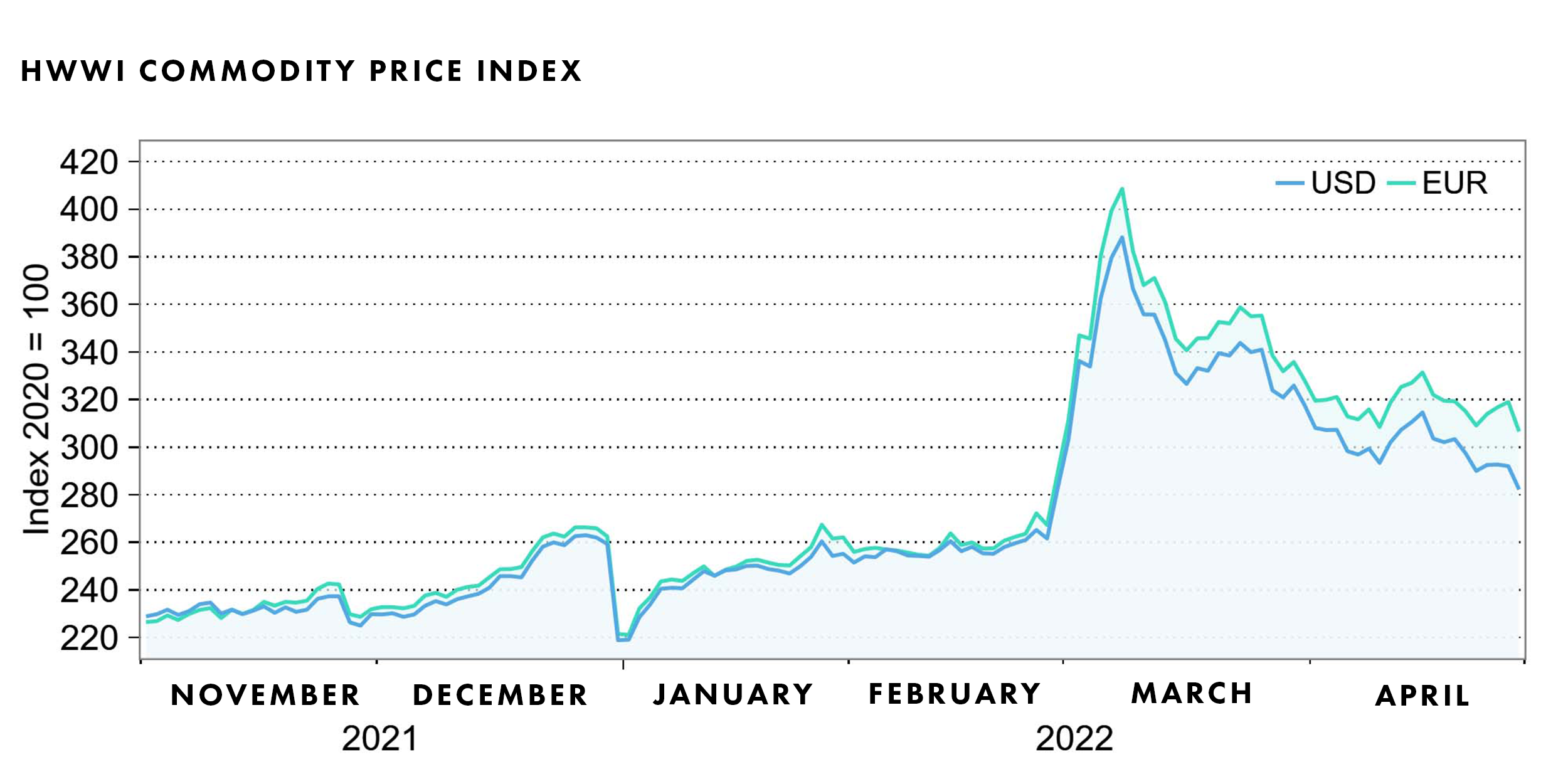

HWWI commodity price index falls slightly in April

- HWWI overall index down 12% (US dollar basis)

- Crude oil prices decreased by 5.7%

- Natural gas prices fell by 22.9%

(Hamburg, May 12, 2022) The HWWI commodity price index fell by an average of 12% in April compared with the previous month. Of the three sub-indices reflected in the overall index (index for energy commodities, index for industrial commodities and index for food and beverages), the index for energy commodities fell the most in April (-13.6%) the index for industrial commodities only slightly (-3.9%), while food and beverages even saw a further slight increase (+1.4%). The declines must be seen against the background of the still very high price level for raw materials. The overall index is 97.9% higher than in April 2021 (food and beverages +34.6%, industrial raw materials +15.5%, energy +123.9%). Commodity prices continue to be driven by the war in Ukraine. The high price level highlights the great importance of Russia, particularly on the markets for energy raw materials. On the grain markets, the continuing high prices additionally reflect Ukraine’s important role as a producer country.

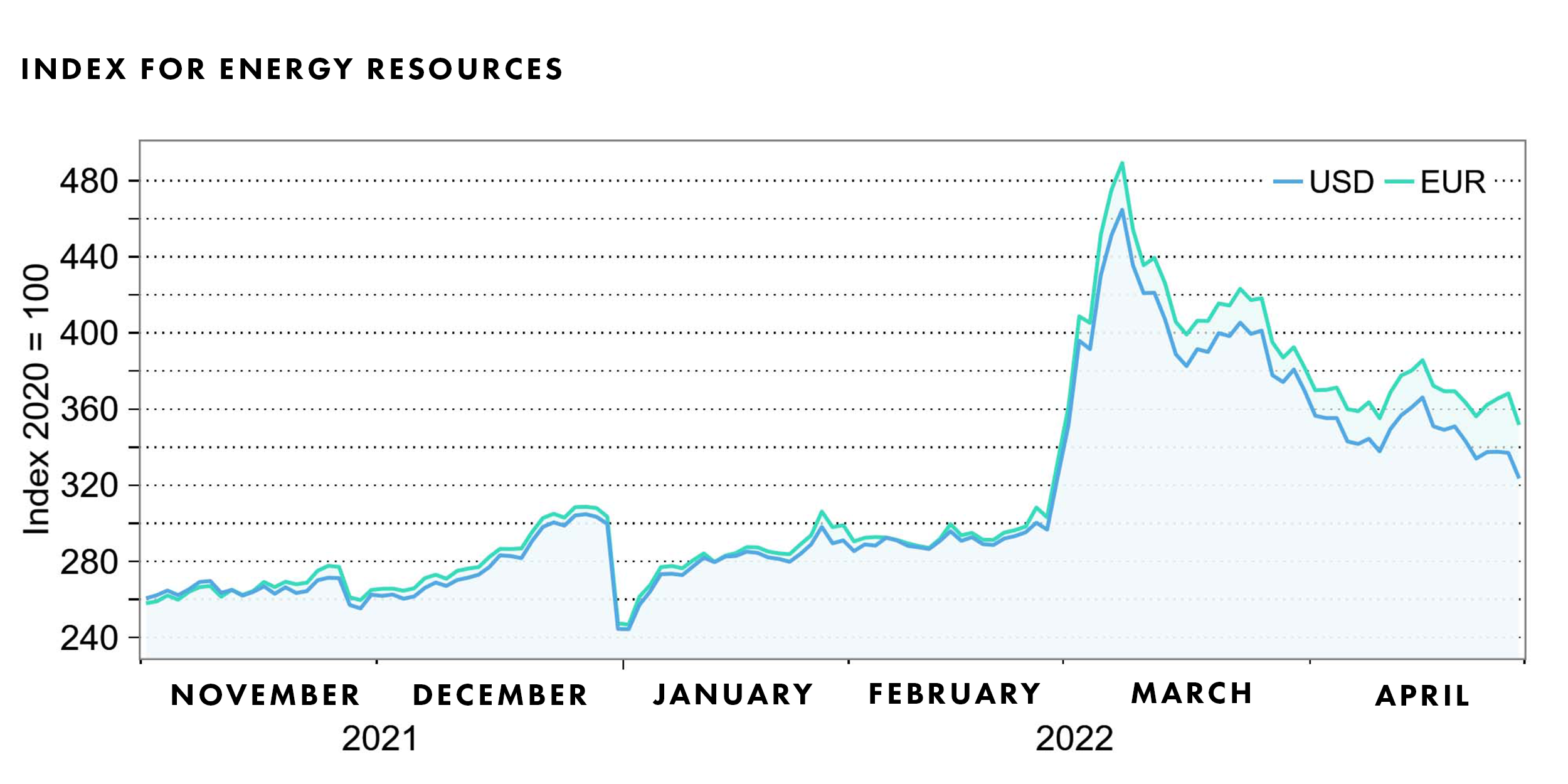

Energy commodities index: -13.6% (euro basis: -12.2%)

The price of crude oil declined slightly in April, falling by 5.7%. The release of part of the U.S. strategic oil reserves announced at the end of March and the increase in oil production decided by the Organization of the Petroleum Exporting Countries including Russia (OPEC+) in March had an impact here. Compared to April 2021, the index increased by 63.1%. The price of coal decreased more than the price of crude oil. The index fell by 10.7% in April and was 223.7% higher than in April 2021.

Among energy commodities, changes in gas prices were the most significant in April. While U.S. natural gas prices rose an average of 34.6% in April from the previous month, European natural gas prices fell 32.8% after rising 72.9% the previous month. Compared with a year earlier, the overall index was 271.5% higher in April.

Overall, the energy commodities sub-index fell by 13.6% (euro basis: -12.2) to 346.6 points (euro basis: 367.0 points).

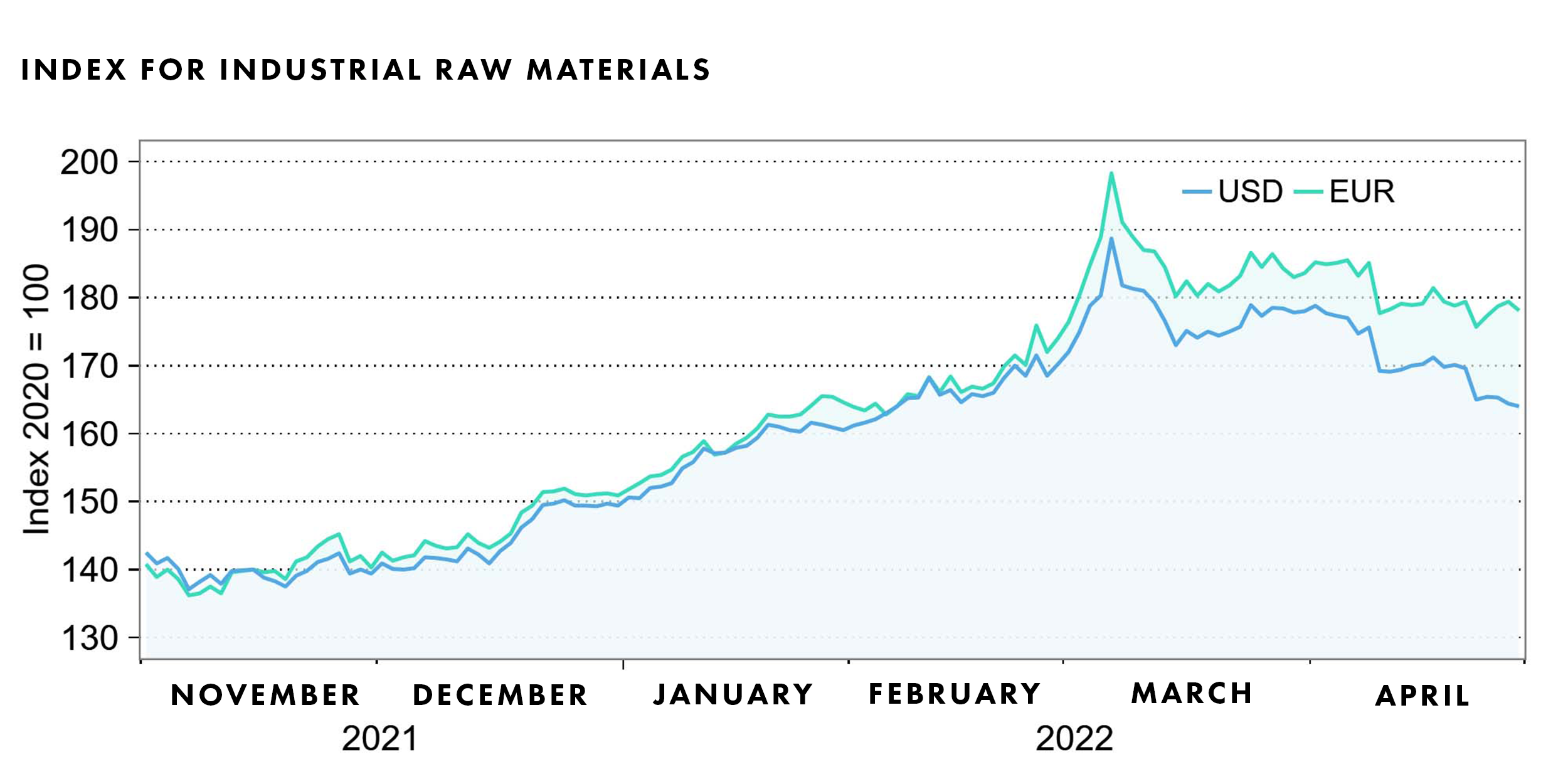

Index for industrial raw materials: -3.9% (euro basis: -2.2%)

The sub-index for industrial raw materials, which is divided into the index for agricultural raw materials, the index for non-ferrous metals and the index for iron ore and steel scrap, fell by 3.9% in April compared with the previous month. This indicates a slight easing overall. However, the index for industrial raw materials is also still 15.5% higher than a year earlier.

Overall, the index for industrial raw materials fell by an average of 3.9% for the month (euro basis: -2.2%) to 170.7 points (euro basis: 180.5 points).

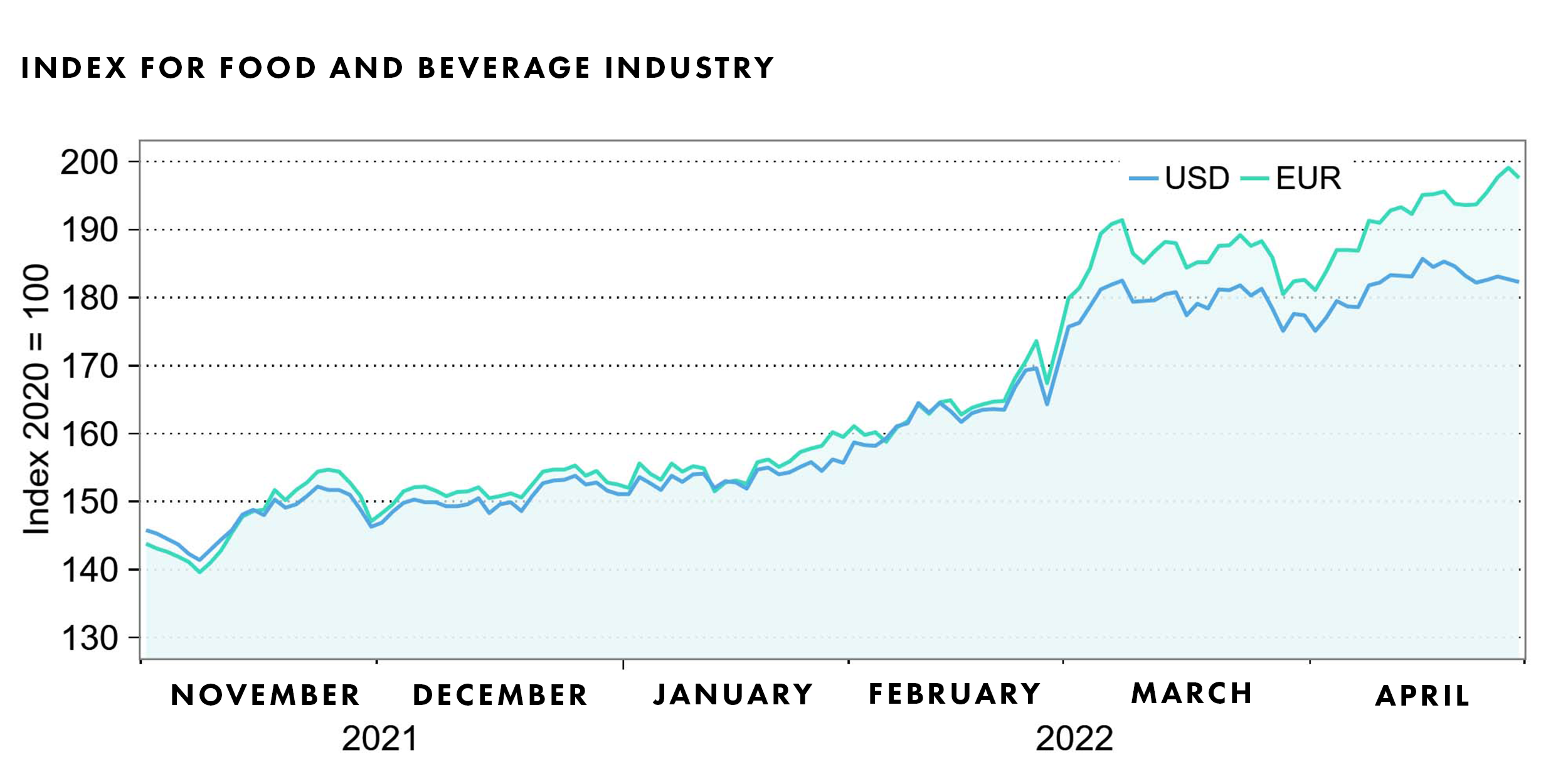

Index for food, beverages and tobacco: +1.4% (euro basis: +3.3%)

Unlike the sub-indices for energy and industrial raw materials, the overall index for food, beverages and tobacco continued to rise in April, up 1.4% on the previous month and 34.6% above the corresponding year-earlier figure. While prices for cereals and luxury foods increased, prices for oilseeds fell slightly (-1.8%).

Overall, the index for food, beverages and tobacco rose by an average of 1.4% for the month (euro basis: + 3.3%) and stood at 181.9 points (euro basis: 192.2 points).

Source: www.hwwi.org