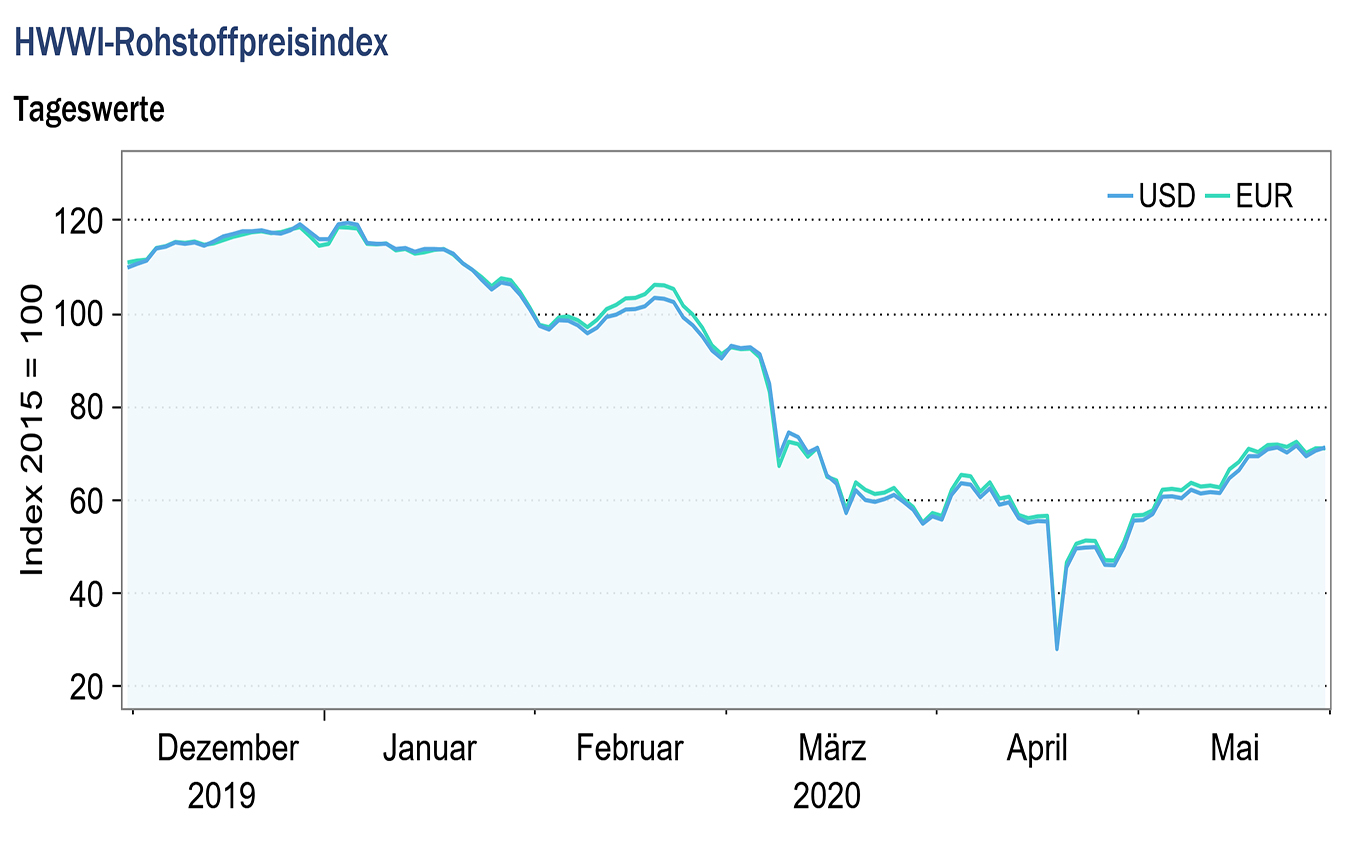

HWWI commodity price index rises for the first time since the beginning of the year

- HWWI overall index increases by 21.7 % (US dollar basis)

- Crude oil prices rise by 39.9

- Slight decrease in prices for food and beverages by 1.8

(Hamburg, 10 June 2020) The decline in the HWWI commodity price index caused by the corona crisis did not continue in May. The HWWI commodity price index rose by an average of 21.7 % (euro basis: +21.2 %) compared with the previous month and stood at 65.3 points (euro basis: 66.5 points). The increase in the HWWI overall index can be explained in particular by the rise in crude oil prices. The sub-index for energy raw materials rose in May by an average of 28.5 % (euro basis: +28.1 %) to 59.7 points (euro basis: 60.7 points) and the index for industrial raw materials also increased in May by 3.5 % (euro basis: +3.2 %) to 110.5 points (euro basis: 112.5 points). The index for food, beverages and tobacco developed in the opposite direction and fell in May by an average of 1.8% (euro basis: -2.1%) to 86.9 points (euro basis: 88.5 points). Compared to the previous month, the index excluding energy increased on average by 1.6% (euro basis: +1.2%) and stood at 100.8 points (euro basis: 102.7 points).

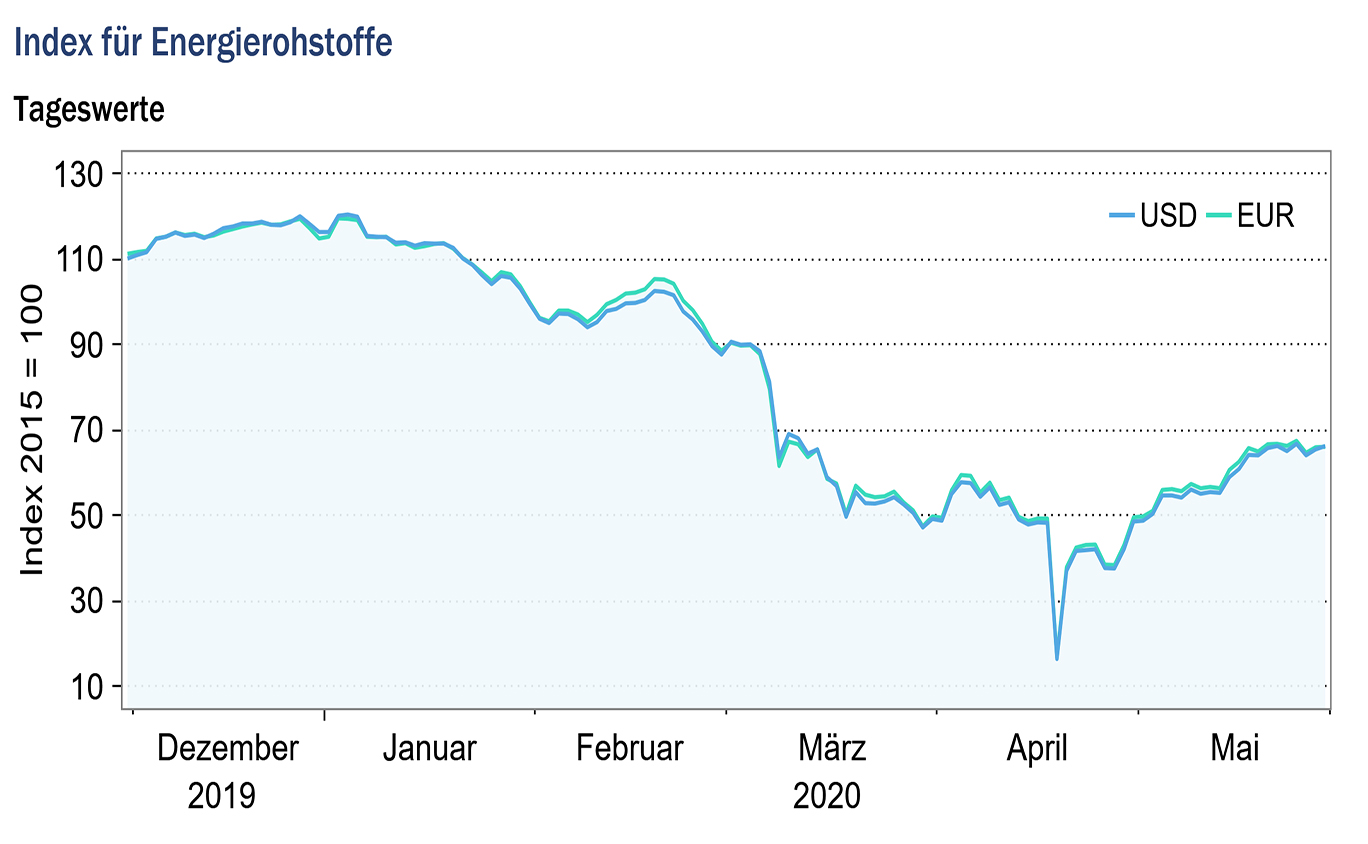

Index for energy raw materials: +28.5% (euro basis: +28.1%)

The decline in crude oil prices observed since the beginning of the year, caused on the one hand by the spread of the corona crisis and on the other by the price war between Saudi Arabia and Russia, did not continue in May. Compared to the previous month, all three types of crude oil included in the index rose by an average of 39.9% in May (euro basis: +39.3%). The rise in crude oil prices was due in particular to a shortage of supply.

In April, an agreement was reached in the price war between Russia and Saudi Arabia, and the OPEC+ countries decided to massively reduce oil production. For May and June, the OPEC+ states committed to reduce oil production by 9.7 million barrels per day, which corresponds to a global supply cut of around 10%. The cuts are to continue to a lesser extent until April 2022. In addition to the production cuts by OPEC+, US shale oil production has collapsed as US shale oil producers were forced to close unprofitable wells due to the sharp drop in crude oil prices.

The recovery of the Chinese economy also led to an increase in demand for oil, which also drove up prices.

In contrast to crude oil prices, coal prices fell further in May. Australian coal prices in particular fell significantly in May compared with the previous month. The global industry, which slowed down due to the Corona-Crisis, also lowered the demand for coal in May and thus the coal prices.

European and American natural gas prices moved in opposite directions in May. While the prices for American natural gas rose slightly, the prices for European natural gas fell significantly compared to the previous month. The decline in prices on the markets for European natural gas has continued since the beginning of the year and reflects falling demand and well-filled natural gas storage facilities.

Overall, the sub-index for energy commodities rose by 28.5 % (euro basis: +28.1 %) to 59.7 points (euro basis: 60.7 points).

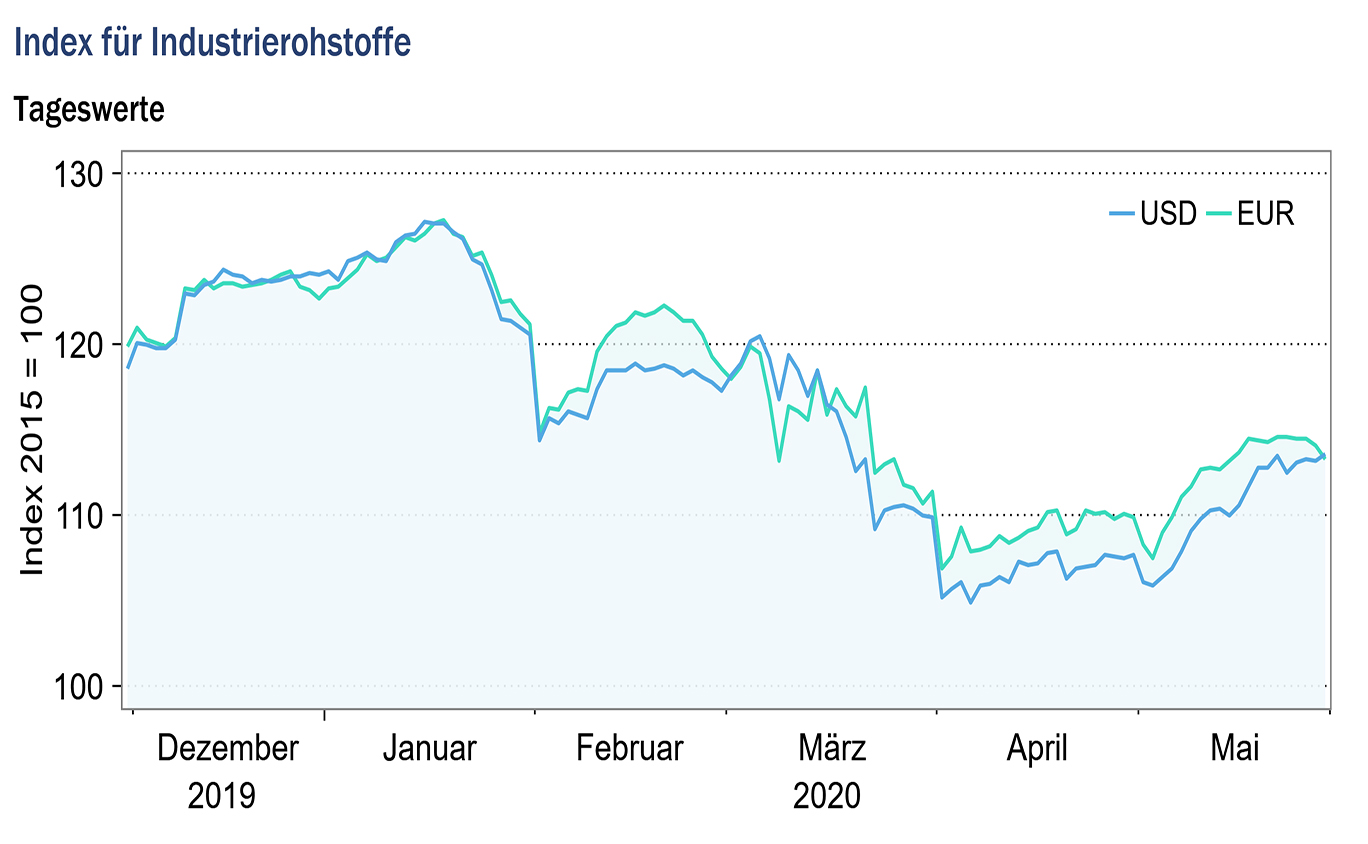

Index for industrial raw materials: +3.5 % (euro basis: +3.2 %)

The sub-index for industrial raw materials is divided into the index for agricultural raw materials, the index for non-ferrous metals and the index for iron ore and steel scrap.

For the first time since the end of January 2020, prices for industrial raw materials rose on a monthly average. Developments on the markets for industrial raw materials in May were particularly influenced by the recovery of Chinese industry. Iron ore prices recorded a particularly sharp rise, which can be explained by the increasing Chinese steel production. Market participants expect that state-financed infrastructure projects in response to the corona crisis will continue to increase demand for steel and thus for iron ore in the future.

A similar picture was seen on the markets for non-ferrous metals. The recovery of the Chinese economy increased the demand for copper, nickel, zinc and tin and caused prices on these markets to rise again.

The decline in prices on the markets for agricultural commodities did not continue in May, as cotton prices in particular rose compared with the previous month. The Chinese textile industry recovered in May after the easing of corona-related restrictions in China. This led to a significant increase in demand for cotton.

Overall, the index for industrial raw materials rose on a monthly average by 3.5% (euro basis: +3.2%) to 110.5 points (euro basis: 112.5 points).

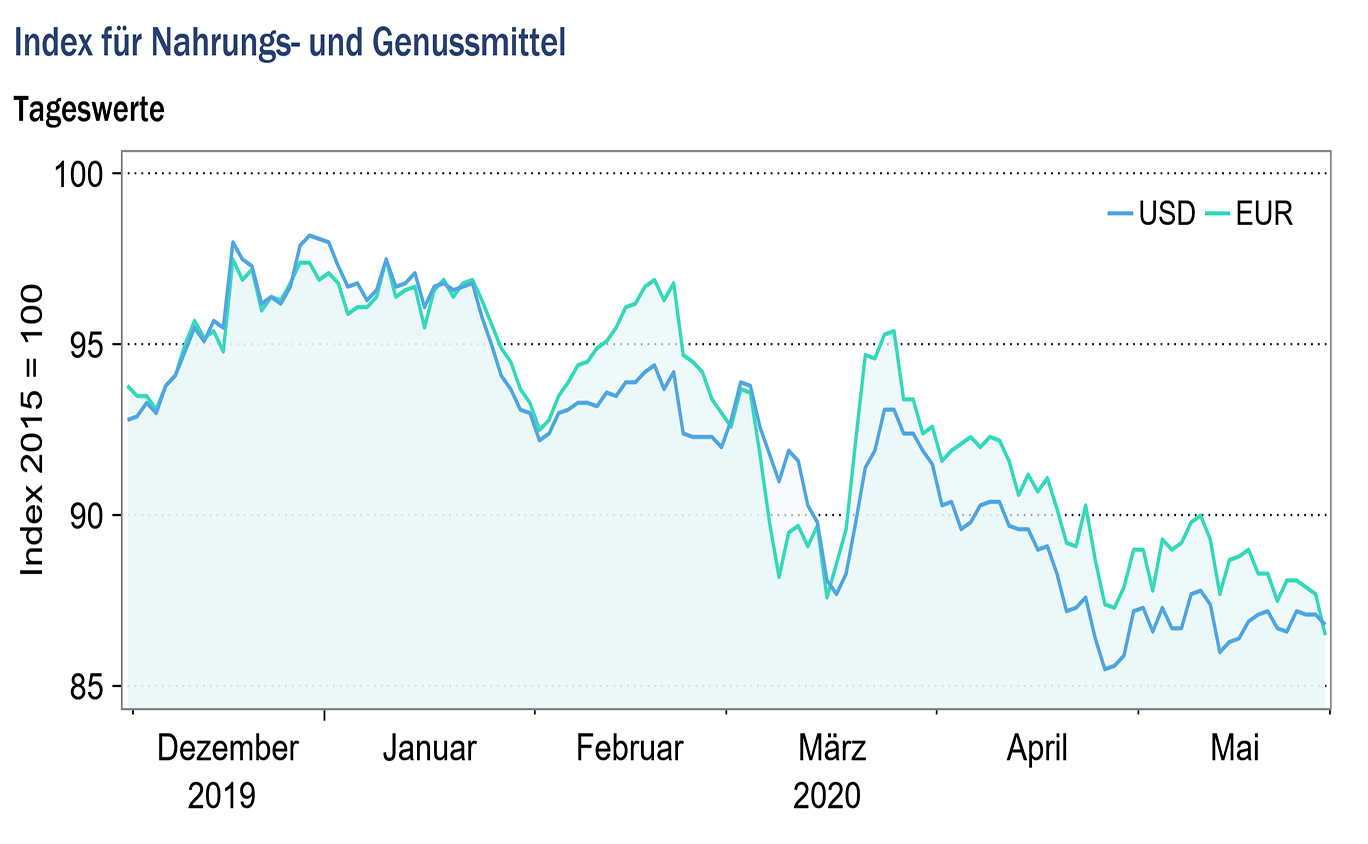

Index for food and beverages: -1.8 % (Euro basis: -2.1 %)

While the majority of the index prices for food and beverages fell on average in May, the prices for cocoa, sugar and tea rose. Sugar prices rose particularly sharply in May, reflecting unfavourable harvest expectations of the major producer countries India and Thailand. The rise in crude oil prices had a price-increasing effect on the sugar markets, as sugar is used in the production of biofuels and the price of sugar is therefore dependent on the price of crude oil.

The ongoing lockdown in India continued to affect tea production in May. The imposed curfews led to a shortage of labour in India and thus to problems in the tea harvest. Due to the reduced supply from India, tea prices rose on average in May compared with the previous month.

Cereal prices, especially rice prices, which had risen in recent months due to feared food shortages, fell again on average in May. In some rice producing countries, such as China and Vietnam, the lockdown measures were relaxed, resulting in increased supply and falling rice prices. The continuing output restrictions in India continue to affect rice supply.

Overall, the index for food and beverages fell by -1.8% on a monthly average (euro basis: -2.1%) and stood at 86.9 points (euro basis: 88.5 points).

Source: www.hwwi.org