HWWI raw material price index falls in October

- HWWI total index fell by 1.8 % (US dollar basis)

- Crude oil price fell by 3.6%

- Index for groceries & luxury goods increased by 3.8 %

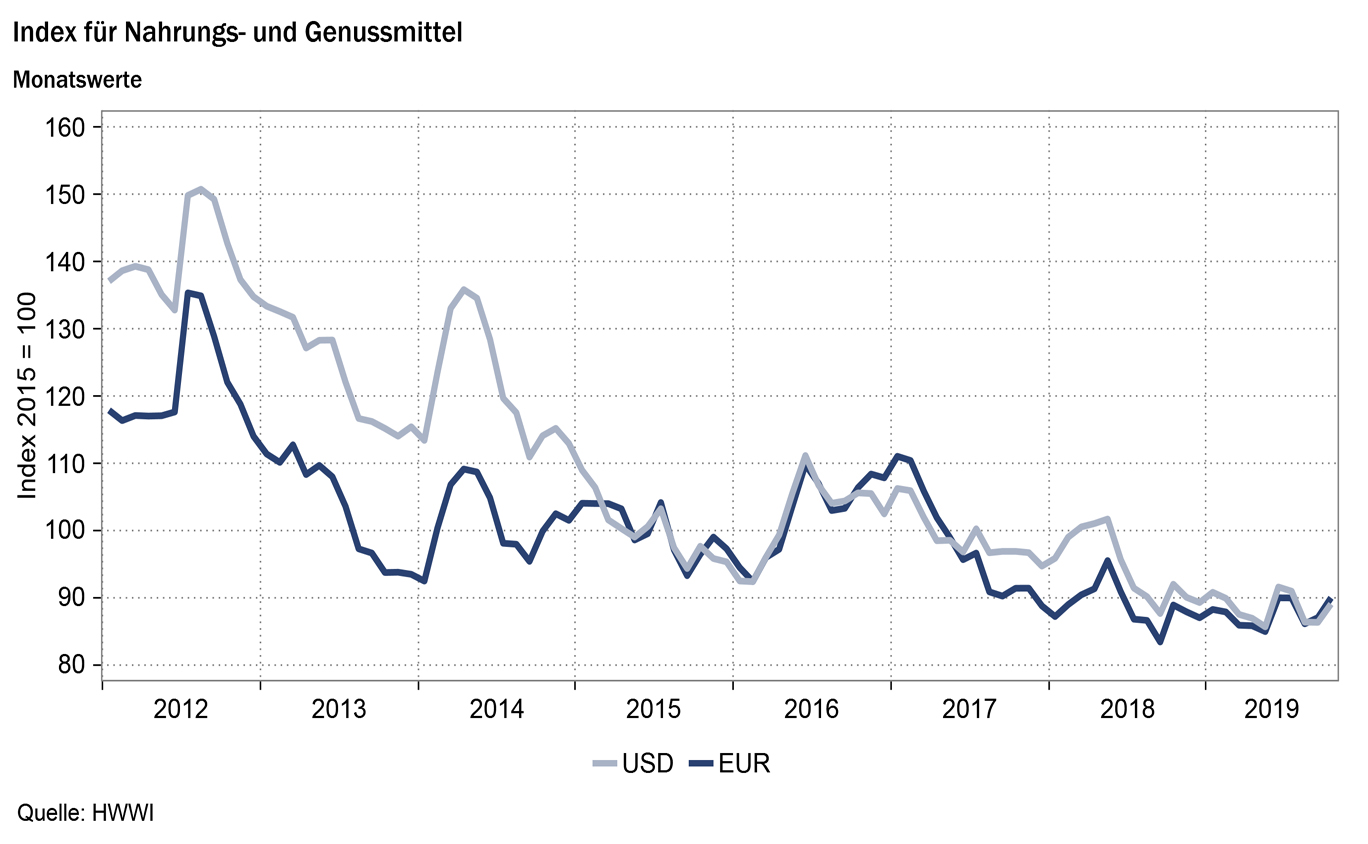

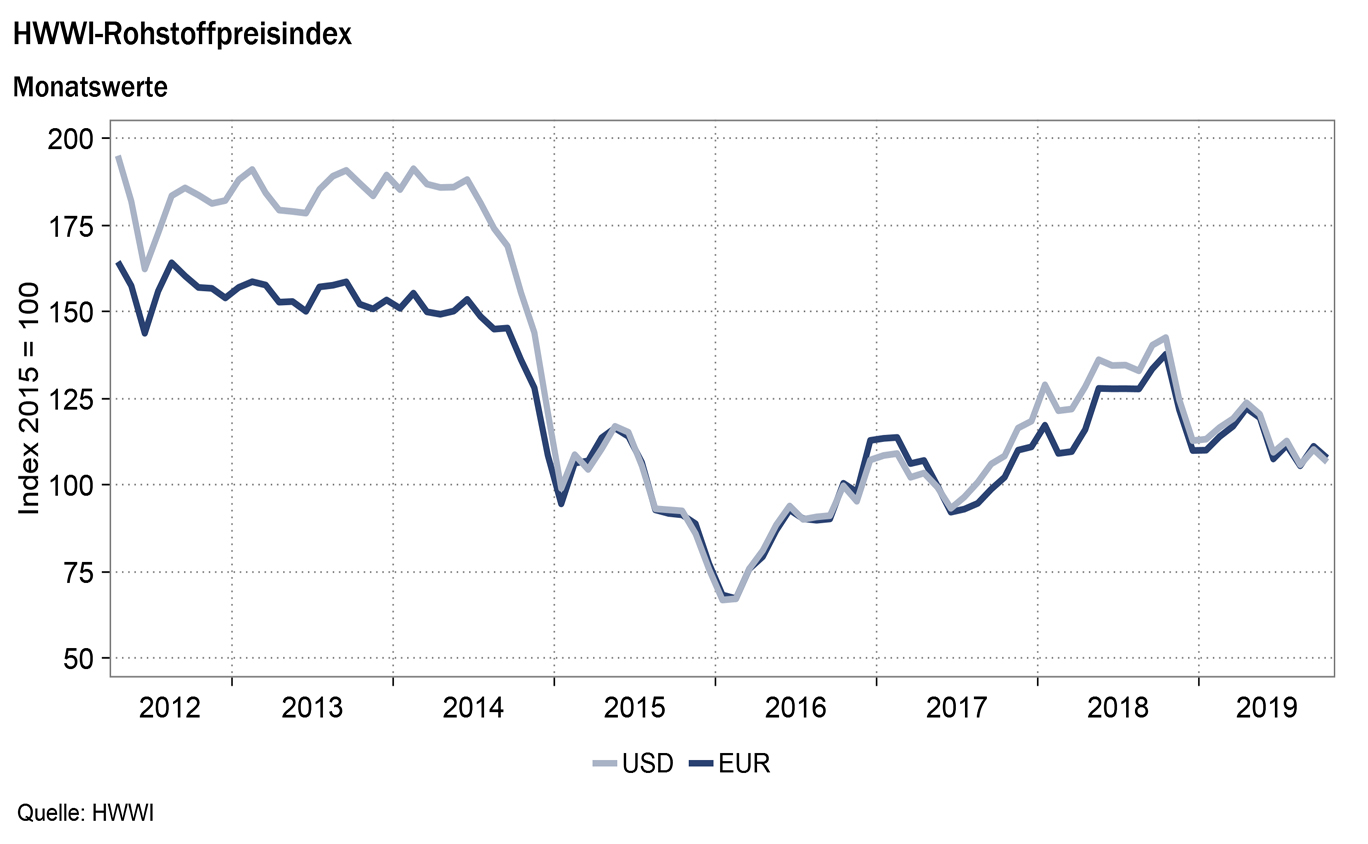

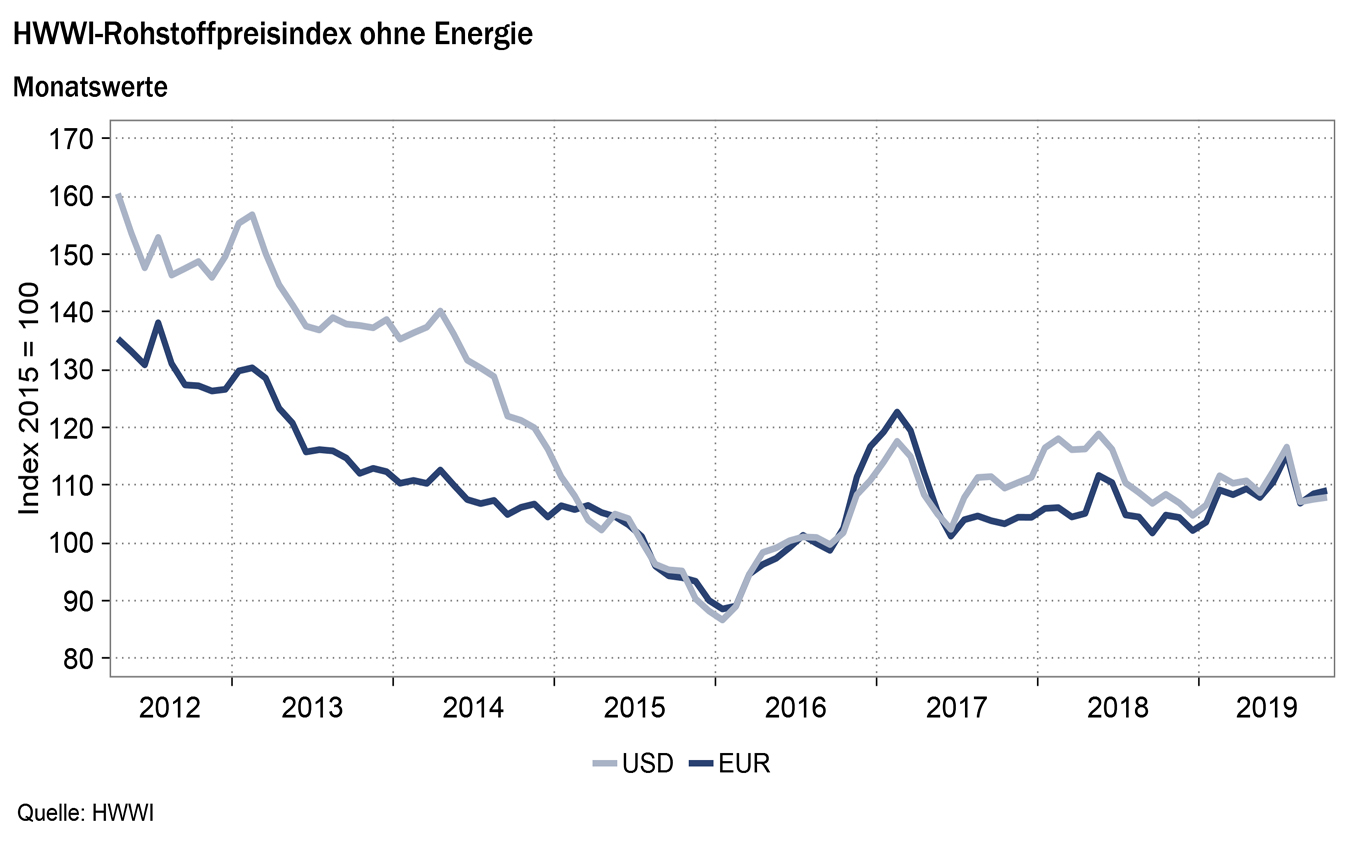

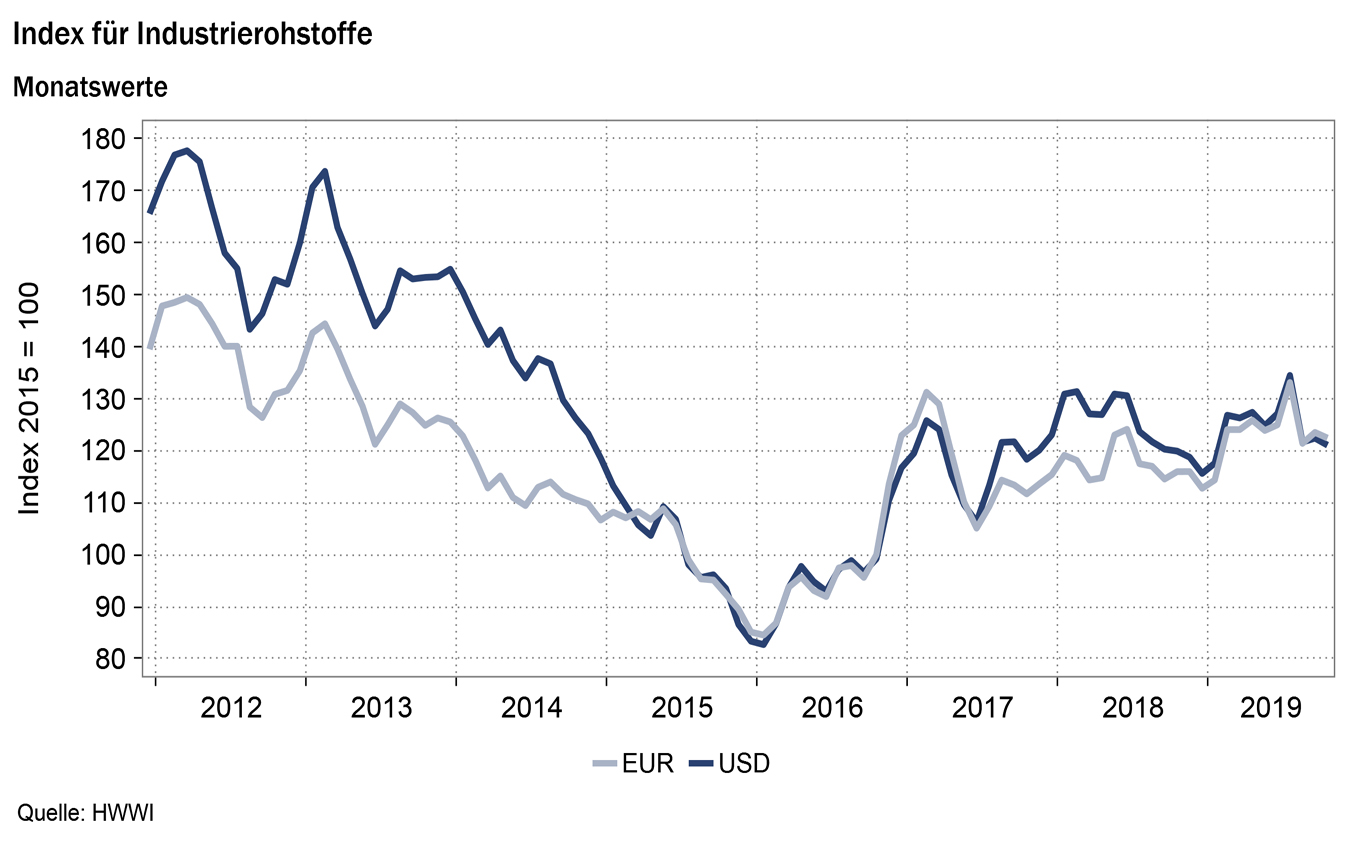

(Hamburg, 8 November 2019) In October, the HWWI raw material price index fell by an average of 1.8 % (-2.2 % in euros) compared with the previous month and stood at 108.4 points (108.8 points in euros). The decline in the HWWI raw material price index is attributable to the decline in crude oil and industrial raw material prices. The short-term price increases recorded on the crude oil market in September did not continue in October. The developments in the sub-indices proceeded in the opposite direction in October. While the indices for industrial and energy raw materials fell, the index for groceries & luxury goods rose significantly in October compared with the previous month. The index for energy raw materials fell by 2.1% (in euros: -2.5%) to 108.5 points (in euros: 108.8 points) and the index for industrial raw materials by 1.4% (in euros: -1.9%) to 120.6 points (in euros: 121.1 points). By contrast, the index for groceries & luxury foods rose by an average of 3.8 % (in euros: +3.3 %) and stood at 89.5 points (in euros: 89.8 points). The index without energy remained virtually unchanged and only rose by 0.3 % (in euros: -0.2 %) to 107.9 points (in euros: 108.3 points).

Index for energy raw materials: -2.1 % (in euro: -2.5 %)

Despite the attack on an Iranian oil tanker in the Red Sea on 10 October and the resulting increase in tensions between Iran and Saudi Arabia, crude oil prices in October fell on average compared with the previous month. Due to the fact that the oil market is characterized by an oversupply of crude oil, the price of crude oil rose only briefly as a result of the oil tanker attack and fell again promptly. Saudi Arabia’s confirmation, that oil reserves had been replenished to their previous level within a very short period of time, because of the drone attack on a Saudi Arabian crude oil refinery in September also strengthened market confidence in the supply of crude oil. On the other hand, the decline in the global economy puts pressure on crude oil prices. The ongoing trade conflict between China and the USA, which continues to slow down the global economy, is also dampening demand for crude oil. The prices of all three types of crude oil (Brent, WTI, Dubai) included in the sub-index for crude oil fell on average in October compared with the previous month. The sub-index for crude oil fell by a total of 3.6% (-4.1% in euros).

In contrast to the crude oil price index, the monthly average index for natural gas rose by 7.5 % (+6.9 % in euros). The upward trend in European natural gas prices continued in October, recording an average price increase of 29 % (+28.3 % in euros) compared with the previous month. Falling temperatures and the associated increase in European the consumption of natural gas led to a further rise in the price of European natural gas in October. In addition, oil production in European countries is stagnating. The UK has recently stopped the controversial fracking of natural gas production, which has reduced production and thus pushed up natural gas prices. The price of US natural gas, on the other hand, fell in October due to the high natural gas inventories in the USA. Natural gas production through fracking is growing steadily in the USA.

Coal prices rose in October compared to the previous month, with the Coal Index rising by 3.6% (+3.1% in euro terms). Overall, the sub-index of energy raw materials fell by 2.1 % (in euros: -2.5 %) due to the price decline on the crude oil market.

Index for industrial raw materials: -1.4 % (in Euro: -1.9 %)

The sub-index for industrial raw materials is subdivided into the index for agricultural raw materials, the index for non-ferrous metals and the index for iron ore and steel scrap. For industrial raw materials fell the sub-index slightly in October, mainly as a result of the progressive price reductions in the iron ore and steel scrap markets. The index for iron ore and steel scrap fell by 3.1% (in euros: -3.5%) compared to the previous month, due to the decline in global steel production due to global economic downturns.

The indices for agricultural raw materials and non-ferrous metals changed only marginally compared with the previous month. The price increases for lead and zinc were balanced by price cuts for aluminum, nickel and tin. The nickel market price increase, which was observed in September did not continue. The announcement by Indonesia, the world’s largest nickel producer, to bring forward the export ban originally planned for 2022 to 2020 initially boosted demand from China and thus nickel prices in September. However, since the largest Chinese nickel producer was confident that Chinese mines would also be able to produce enough nickel in the future to close the supply gaps created by the export freeze, the price of nickel fell again in October. Due to an unexpected shortage of supply, prices on the lead market rose. The rise in the zinc price is also due to low inventories, which exceeded the price pressure due to the poor economic outlook.

Overall, the index for industrial raw materials fell by an average of 1.4% (-1.9% in euros) to 120.6 points (121.1 points in euros).

Index for groceries & luxury goods: +3.8 % (in euro: +3.3 %)

On a monthly average, prices for groceries & semi-luxury goods have risen significantly. In October, the sub-index for semi-luxury goods recorded an average increase of 2.5% (+2.0% in euros) compared with the previous month, due to price increases on the markets for sugar and cocoa. The sharp rise in sugar prices is due to Brazil’s downward revision of harvest expectations in its main growing regions. In Brazil, the proportion of sugar cane used for ethanol production is also growing, which in turn is reducing sugar production. In addition, India also corrected the sugar harvest downwards due to monsoon flooding in the growing regions.

The sub-indices for cereals also rose by 5.4 % (in euro: +4.9 %) and for oilseeds and oils by 4.0 % (in euro: +3.5 %) on a monthly average. The onset of winter in the American corn growing regions reduced production expectations and pushed up the price of corn. The American government’s announcement that oil refineries will be obliged to add corn-based ethanol to gasoline in the future has also fueled expectations of an increase in corn demand. The rapprochement between the US and China in the trade war has led to higher prices for soybeans and soybean oil. One of the aims of the recently concluded partial agreement is to enable China to import agricultural products, especially soybeans, from the USA again.

Overall, the monthly average index for groceries & luxury goods rose by 3.8 % (in euros: +3.3 %) and stood at 89.5 points (in euros: 89.8 points).