HWWI raw material price index falls significantly in February

- HWWI overall index fell by 12.2 % (US dollar basis)

- Crude oil prices dropped by 13.5

- Price decline of 5.8 % on the markets for industrial raw materials

(Hamburg, March 17, 2020) In February, the HWWI commodity price index fell by an average of 12.2% (euro basis: -10.6%) compared with the previous month and stood at 98.4 points (euro basis: 100.1 points). Due to the rapid spread of the coronavirus, all indices included in the HWWI commodity price index fell last month. The sub-index for energy raw materials fell in February by an average of 13.4% (euro basis: -11.8%) to 96.9 points (euro basis: 98.6 points) and the index for industrial raw materials fell by 5.8% (euro basis: -4.1%) to 117.5 points (euro basis: 119.6 points). The index for food and beverages fell comparatively less sharp by 3.1% (Euro basis: -1.4%) to 93.1 points (Euro basis: 94.7 points). The index excluding energy fell by 4.9% (Euro basis: -3.2%) to 107.5 points (Euro basis: 109.4 points).

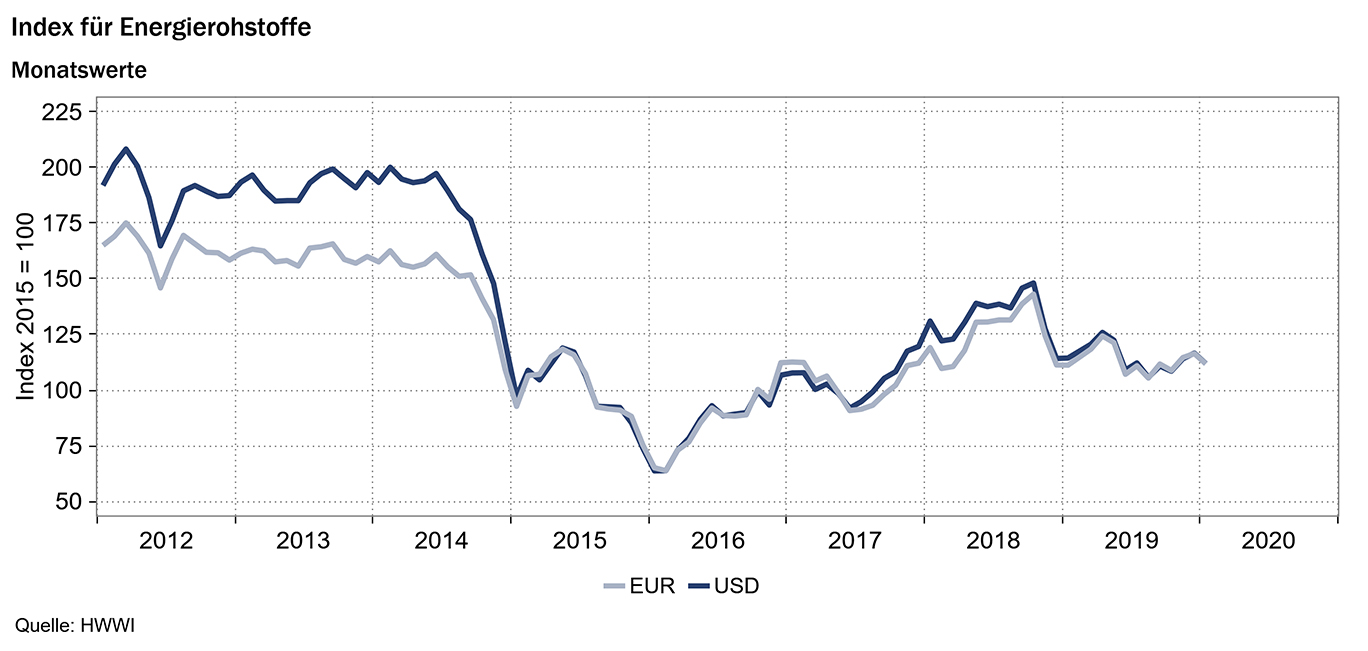

Index for energy raw materials: -13.4 % (euro basis: -11.8 %)

The downward trend in oil prices intensified in February as the coronavirus increasingly spread, particularly in China but also worldwide. The spread of the virus led to a significant reduction in demand for crude oil, as the virus significantly curbed economic activity in February, particularly in China. The quarantine measures imposed by the Chinese government led to empty streets, significantly reduced air traffic and paralyzed industry, which in turn led to a collapse in demand for oil and lower oil prices. In order to counteract the fall in prices on the oil markets, OPEC’s Joint Technical Committee decided at the beginning of February to maintain the current production volume cuts until the end of 2020 and also recommended that production volumes be further reduced. However, Russia refused to agree to the additional cuts, so that no agreement has yet been reached between the OPEC+ states. The unsuccessful negotiations between OPEC and Russia also put pressure on crude oil prices. On 29 February, prices reached a monthly low of US$ 50.1 per barrel of Brent crude and US$ 45.26 per barrel of WTI. Further negotiations in March will show whether the OPEC+ states can agree on further cuts in production volumes.

European and American natural gas prices also fell significantly in February compared with the previous month. In particular, the European natural gas price recorded a sharp fall, which was mainly due to the unusually warm temperatures in Europe in February. The mild temperatures led to a low consumption of natural gas. But February also saw relatively warm temperatures in the USA, which reduced gas consumption and also depressed the prices of American natural gas.

Overall, the sub-index for energy commodities fell by 13.4 % (euro basis: -11.8 %) to 96.9 points (euro basis: 98.6 points).

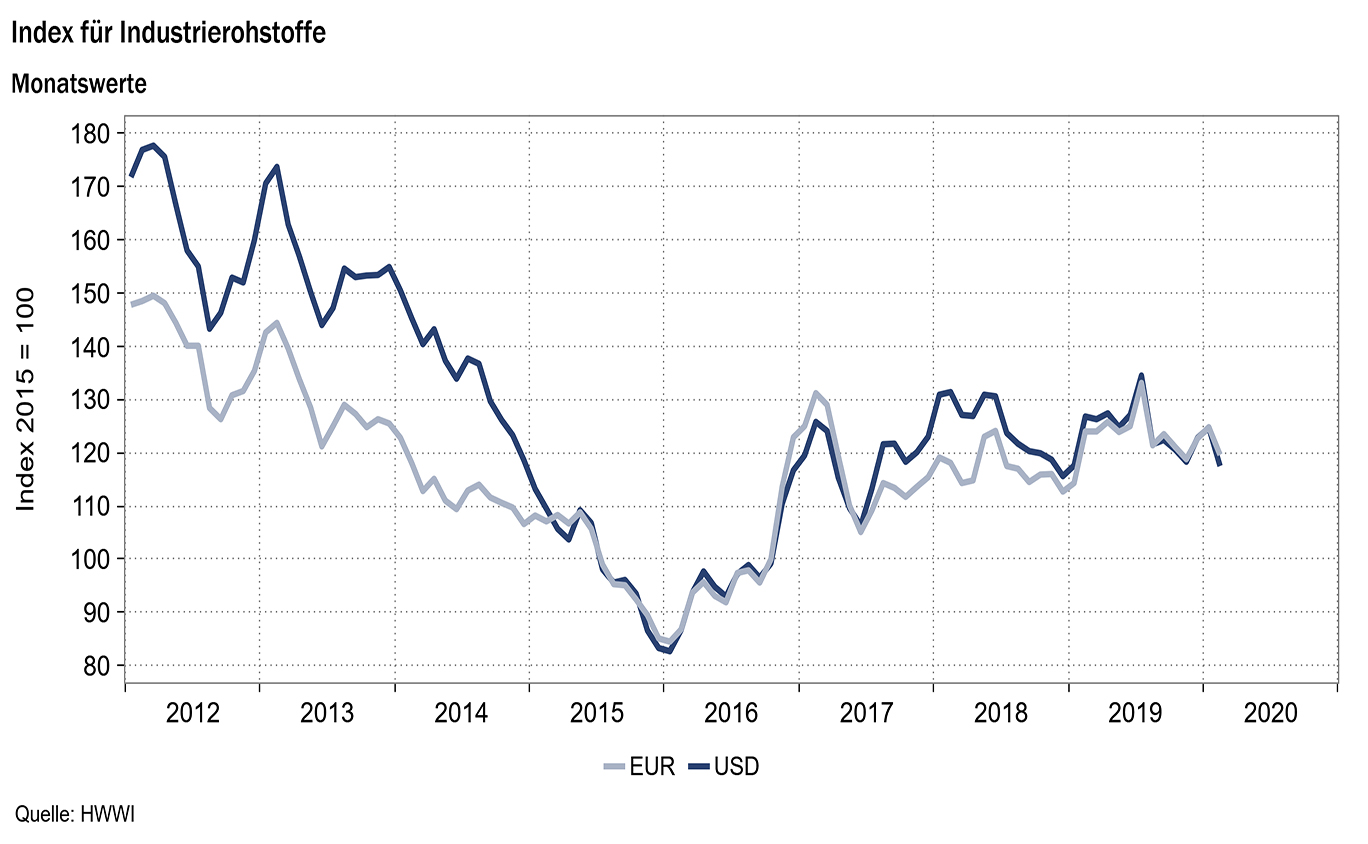

Index for industrial raw materials: -5.8 % (euro basis: -4.1 %)

The sub-index for industrial raw materials is divided into the index for agricultural raw materials, the index for non-ferrous metals and the index for iron ore and steel scrap. All three sub-indexes also declined, reacting to the rapid spread of the corona virus. In particular, the coronavirus slowed down Chinese growth and thus significantly reduced demand for industrial raw materials. As China is both the world’s largest producer and largest consumer of industrial metals, the slowdown in Chinese industry had an impact on prices on the metal markets. Prices for steel scrap and iron ore fell due to the decline in Chinese steel production. However, copper, nickel and zinc prices also fell significantly in February, reflecting the slowdown in economic activity, particularly in China.

The index for agricultural industrial raw materials fell only slightly in February, as the prices for sawn timber rose in February in contrast to the other raw material prices. However, prices for rubber, cotton and Australian wool fell due to reduced demand, particularly from China. The global spread of the coronavirus is also to be the reason for the fall in prices.

Overall, the index for industrial raw materials fell by 5.8 % (euro basis: -4.1 %) on a monthly average to 117.5 points (euro basis: 119.6 points).

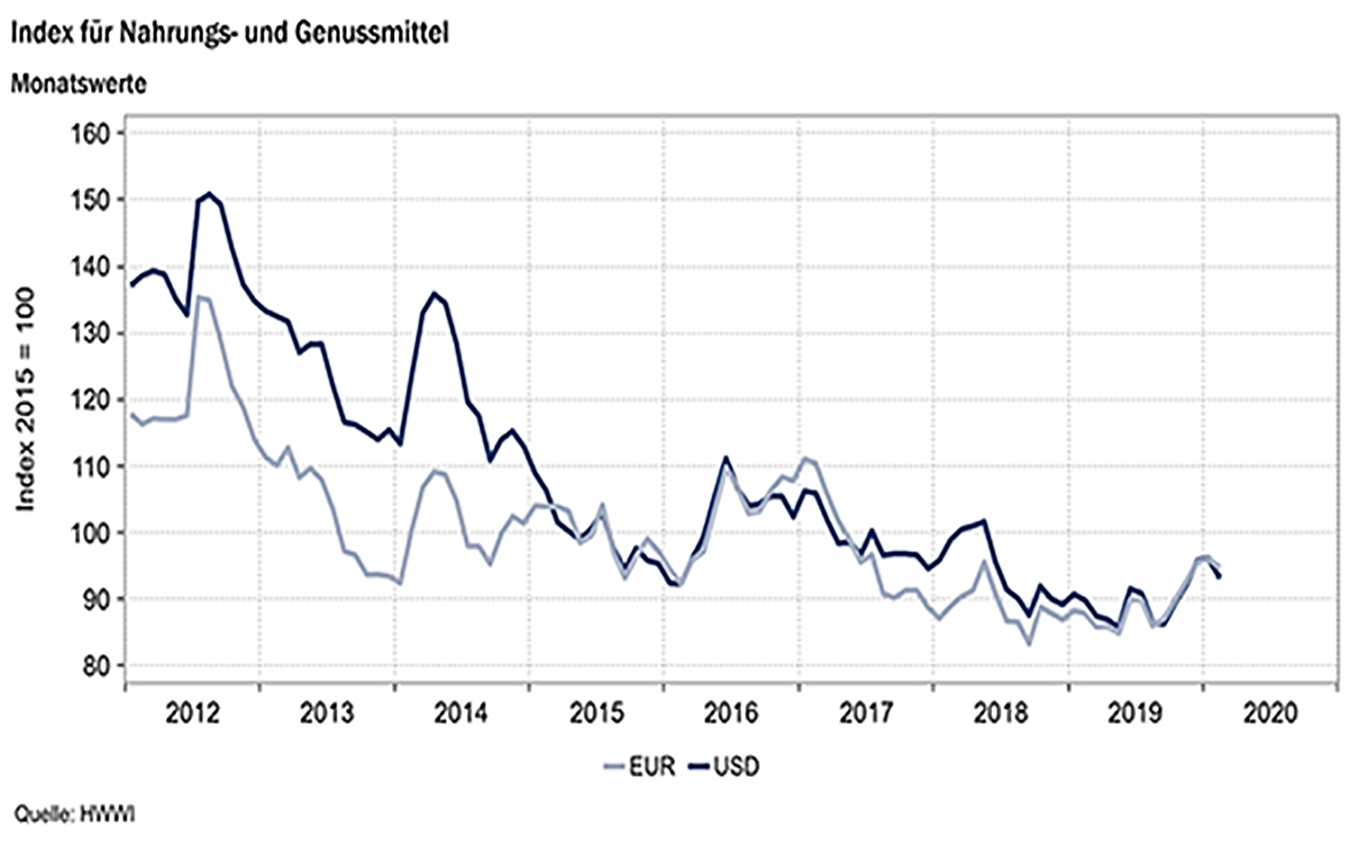

Index for food and beverages: -3.1 % (euro basis: -1.4 %)

Despite the spread of the coronavirus, the index for food and beverages fell by only a relatively small 3.1% (euro basis: -1.4%) compared with developments in the other sub-indices. The index values for oils and oilseeds and also for cereals decreased due to the expected decrease in demand from China. However, the prices for semiluxury items remained almost unchanged in February. While the prices for coffee and tea also fell in February, the markets for sugar and cocoa were an exception and showed rising prices. The price increase in the sugar market was due to supply shortages. In the major producing countries India and Thailand, unfavourable weather conditions destroyed large parts of the sugar cane harvest. In addition, Brazil is increasingly using sugar cane for the production of ethanol as fuel, so that smaller quantities of the raw material are used in food production. The reason for the price increase on the cocoa market is the merger of Ghana and the Ivory Coast into a cocoa cartel. The cartel aims to impose a price premium of 400 dollars per tonne on customers from October 2020. The price premium is intended to guarantee cocoa farmers a price equal to the fair trade buyer price in future. The initiative by Ghana and the Ivory Coast led to price increases in advance. In the future, it will become clear whether the increased prices can be maintained in the long term or whether production in other countries will be expanded, which in turn would lead to falling prices.

Overall, the index for food and beverages fell by -3.1 % on a monthly average (euro basis: -1.4 %) and stood at 93.1 points (euro basis: 94.7 points).

Source: www.hwwi.org