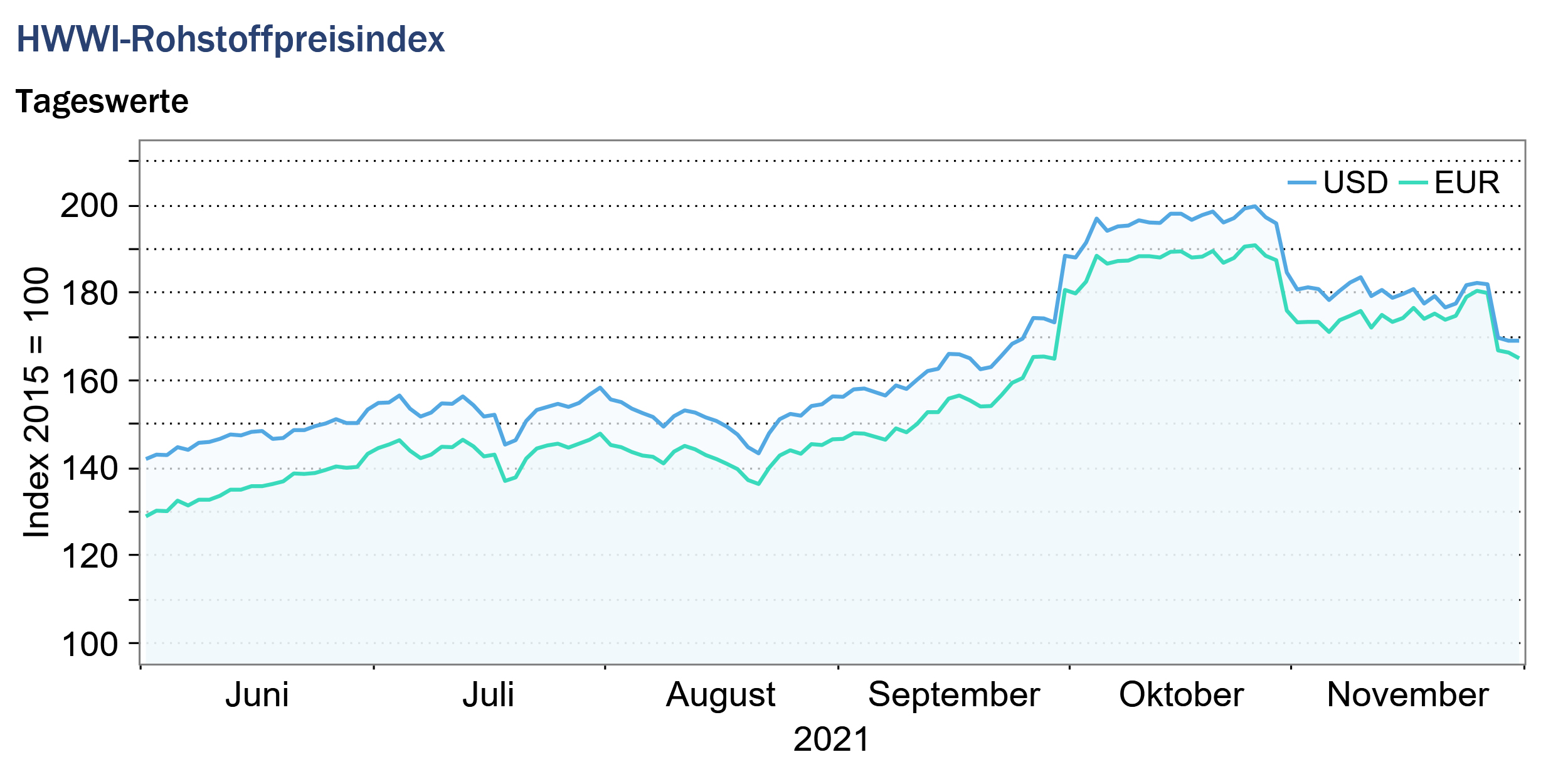

HWWI commodity price index fell in November

- HWWI overall index fell by 8.6% (US dollar basis)

- Crude oil prices fell by 2.7%

- Natural gas prices fell by 17.9%

(Hamburg, December 9, 2021) The HWWI commodity price index fell in November after rising sharply in previous months. Compared to October, the index value fell by 8.6%, averaging 92.6% higher than in November a year ago. The price decline was due to the sharp price falls on the energy commodity markets. The strong upward trend in energy commodity prices, which had continued for several months, was interrupted in November as the new variant of the coronavirus caused uncertainty on the commodity markets. Prices for industrial raw materials also declined in November, particularly for iron ore and aluminum. In contrast, prices for food and beverages increased on average in November compared with the previous month.

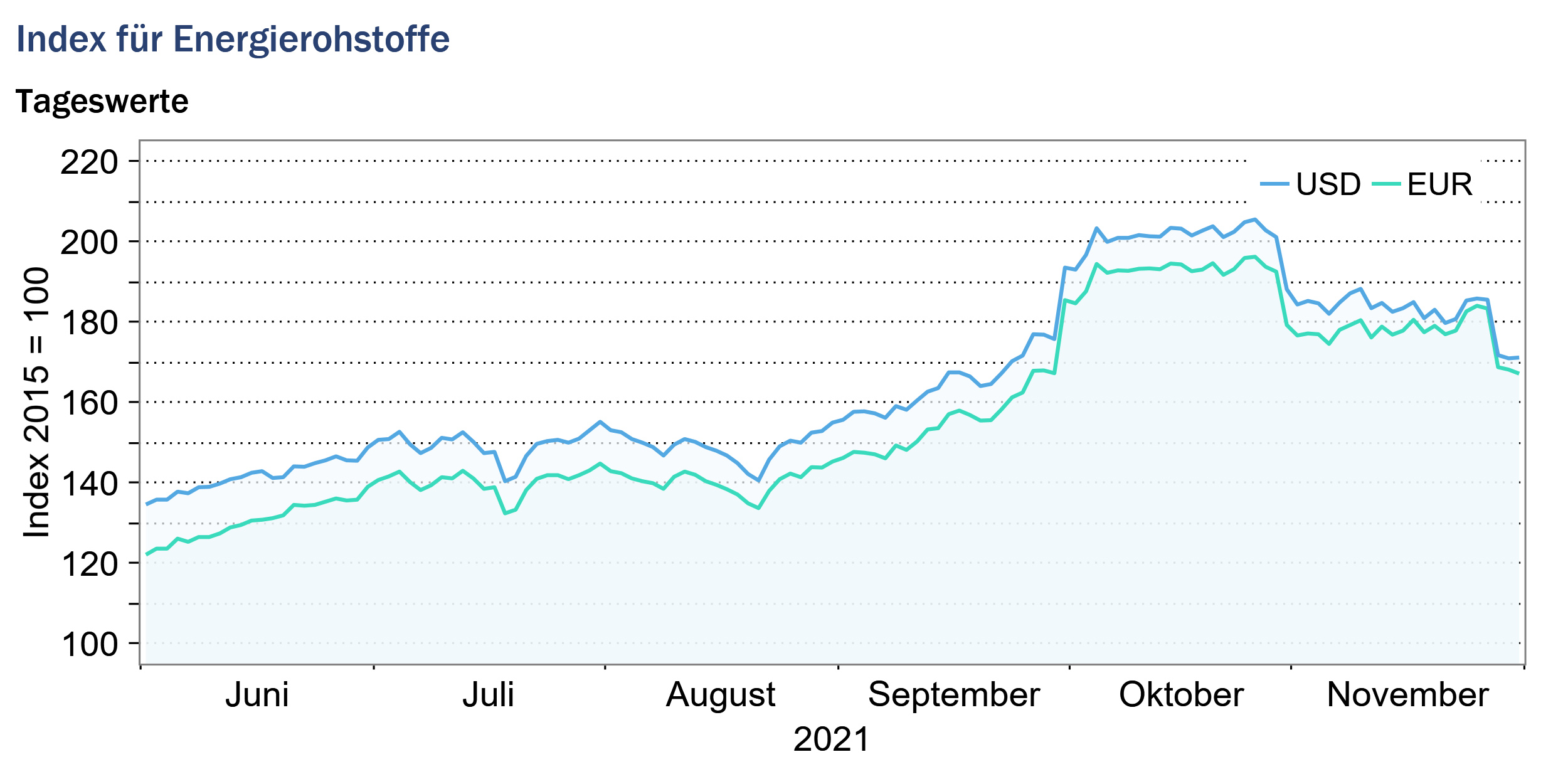

Index for energy raw materials: -9.3% (euro basis: -7.3%)

Crude oil prices fell by an average of 2.9% in November compared with the previous month, after rising sharply in the preceding months. Prices for European benchmark Brent crude began the month at around 85 U.S. dollars per barrel and ended it at 70 U.S. dollars per barrel. Prices for the U.S. reference grade WTI even fell to 66 U.S. dollars per barrel at the end of the month. However, this still left average crude oil prices in November almost 85% higher than the corresponding year-earlier figure.

The price drop was triggered by the appearance of the Omikron virus variant. The new, rapidly spreading virus variant is currently causing uncertainty on the crude oil markets. The impact of the new Omikron variant on the pandemic situation and thus on the global economy cannot yet be assessed. Should the new virus variant lead to renewed global lockdown measures, this would have a significant impact on global crude oil demand. Despite lower crude oil prices, OPEC+ announced in early December that it would stick to its planned gradual increase in oil supply.

In addition to crude oil prices, prices for other energy commodities also fell in November. Both Australian and South African coal prices fell significantly in November compared with the previous month. After coal prices had risen sharply in recent months and reached record highs, the Chinese government intervened in the market and introduced price caps for domestic coal. The measure led to panic selling and caused prices to fall on the world markets for coal.

Prices for natural gas also fell in November compared with the previous month. Prices for European natural gas, which had exceeded record highs in previous months, fell by an average of over 20% for the month. One reason for the price drop is that Russia increased natural gas supplies to Europe again in November. In addition, mild winter weather in Europe is currently causing lower demand for natural gas. The new virus variant Omikron is also having a price-dampening effect on the natural gas markets.

Overall, the energy commodities sub-index fell by 9.3% (euro basis: -7.3%) to 182.4 points (euro basis: 177.3 points).

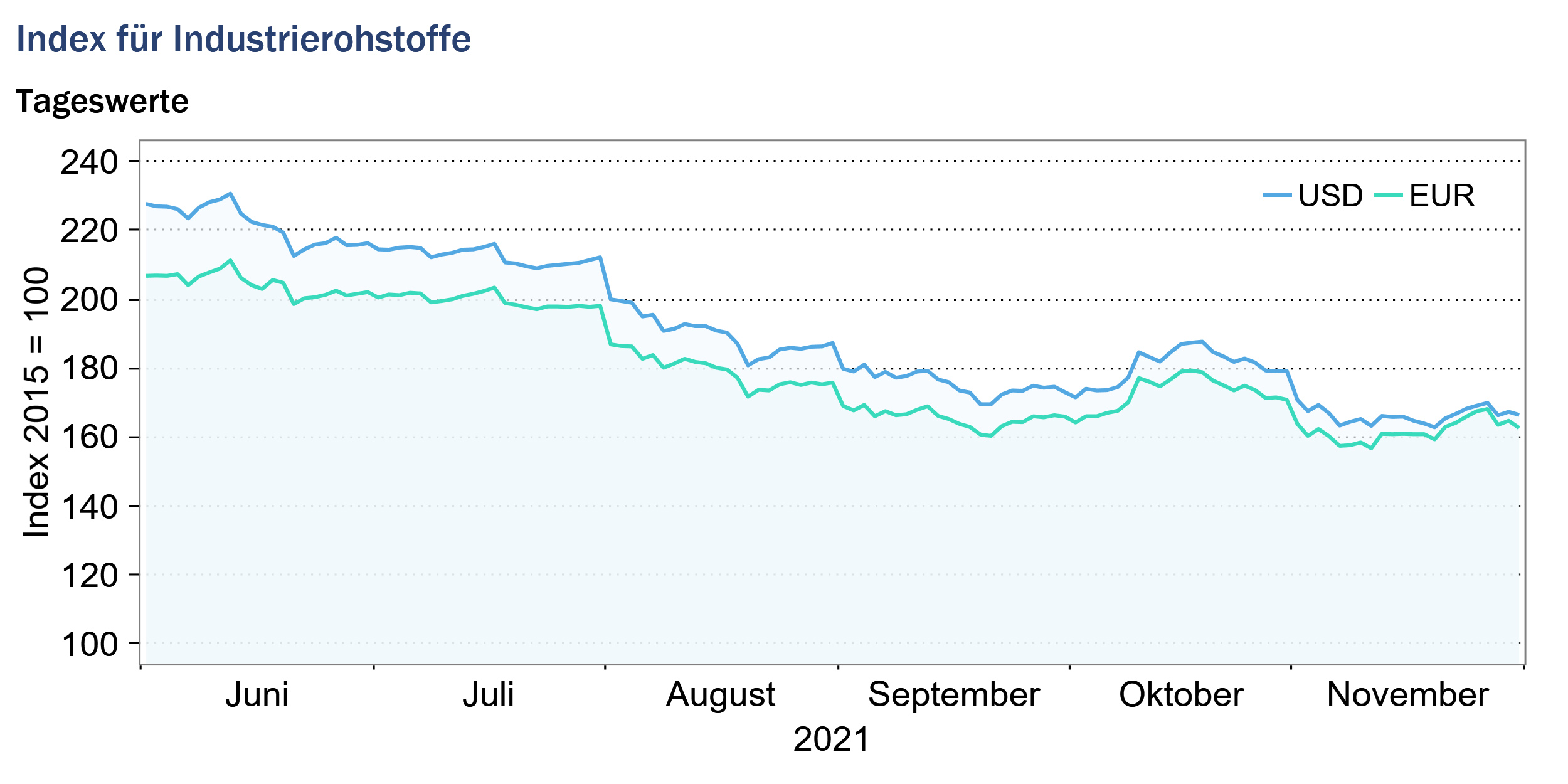

Industrial raw materials index: -7.9% (euro basis: -6.4%)

The sub-index for industrial raw materials, which is broken down into the index for agricultural raw materials, the index for non-ferrous metals and the index for iron ore and steel scrap, fell by 7.9% in November compared with the previous month. While prices for agricultural raw materials rose on average in November, prices for nonferrous metals and iron ore and steel scrap fell.

Iron ore prices fell particularly sharply in November, especially in the first half of the month, continuing the downward trend already seen in October. In November, iron ore prices fell by an average of 22% compared with the previous month. Cuts in Chinese steel production aimed at limiting climate-damaging emissions reduced demand for iron ore and depressed prices. Iron ore prices rebounded at the end of November in response to an increase in Chinese iron ore imports.

The decline in nonferrous metal prices was due to the sharp fall in prices on the aluminum market. Aluminum prices fell by 10% in November after reaching highs in mid-October. The fall in energy prices led to expectations that previously curbed energy-intensive aluminum production would be expanded again. By contrast, tin and nickel prices increased slightly from the previous month, and copper and zinc prices decreased slightly on average for the month.

Lumber prices continued their upward trend in November, reflecting tight supply combined with high demand. Lumber supply was further tightened in November as heavy rains in Canada led to flooding and problems with lumber deliveries.

Overall, the index for industrial raw materials fell by an average of 7.9% (euro basis: -6.4%) to 166.3 points (euro basis: 161.8 points) for the month.

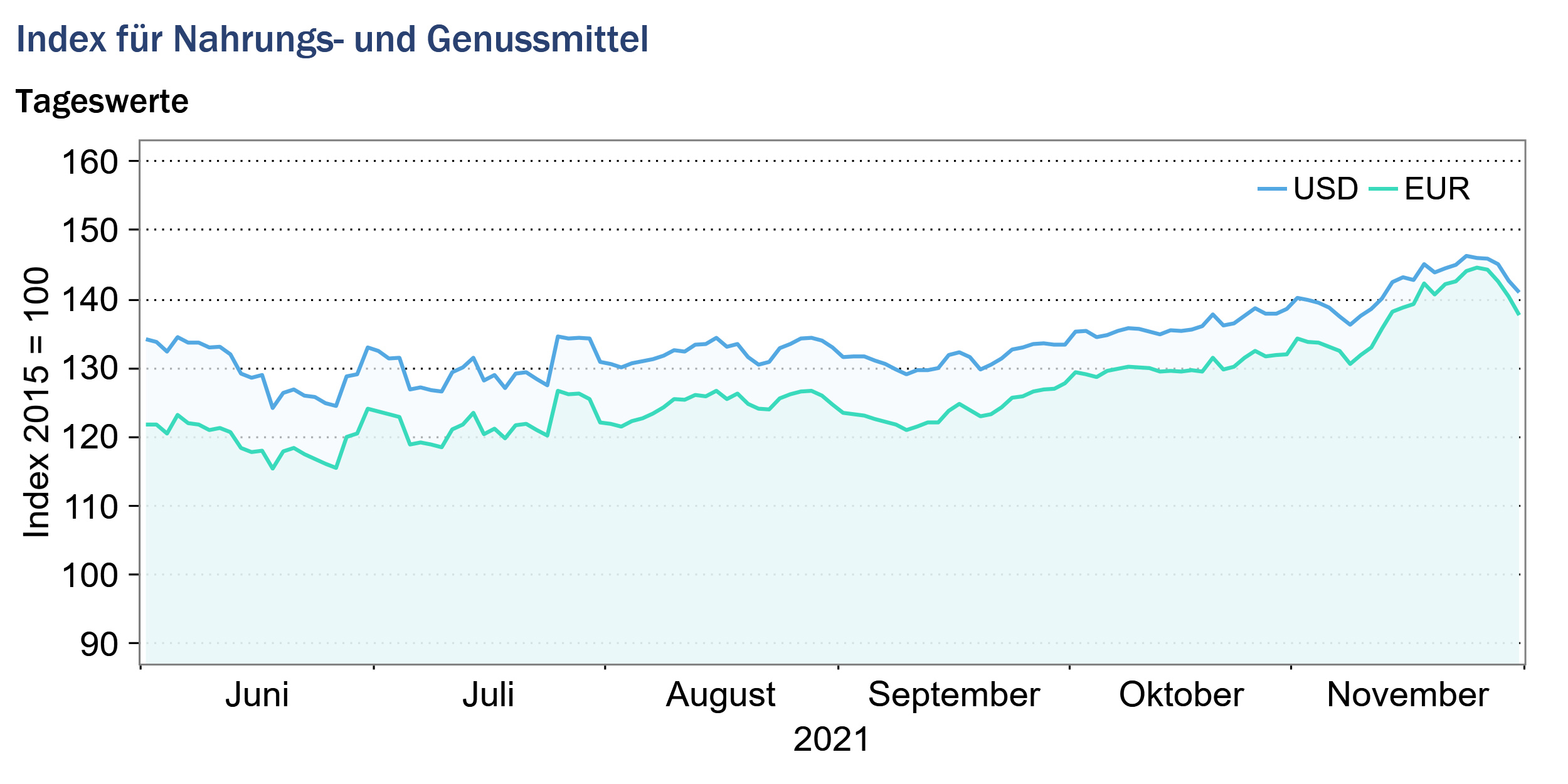

Index for food, beverages and tobacco: +4.2% (euro basis: +5.9%)

The index for food, beverages and tobacco rose by an average of 4.2% in November compared with the previous month and was thus 31.7% higher than the corresponding year-earlier figure. All three sub-indices, the index for cereals, the index for luxury foods, and the index for oils and oilseeds, rose on average in November.

Average cereal prices rose particularly sharply in November compared with the previous month, due to sharp price increases on the markets for corn and wheat. Wheat prices in November approached the highs of 10 years ago. Strong demand for wheat continues to meet tight supplies, leading to price increases. As a result, major wheat importers announced large purchase offers in early November. On the supply side, heavy rains in Australia, flooding in Canada and drought in key growing regions of the U.S. led to tighter supplies. However, by the end of the month, grain prices, particularly wheat prices, had fallen again. The price decline was triggered by the emergence of the new virus variant Omikron and reflects concerns about the impact of a further spread of Omikron on demand for cereals.

Prices for luxury foods moved in opposite directions in November. While coffee prices continued to rise, cocoa prices fell from the previous month. The price of coffee rose by 7.5% from the previous month and exceeded its ten-year high. Severe frosts destroyed large areas of coffee plantations in Brazil’s main growing regions and reduced global coffee supplies. In contrast, global coffee demand is steadily increasing year on year. In November, supply was further tightened by temporary supply disruptions from Brazil due to container shortages.

The picture was different on the cocoa markets, where further price declines were observed in November. Rainfall in the main growing areas of Côte d’Ivoire supported the coffee harvest. The decline in cocoa prices may also be due to uncertainty about the new virus variant Omikron. New lockdown measures and contact restrictions could again weaken demand for chocolate and thus cocoa.

Overall, the index for food, beverages and tobacco rose by an average of 4.2% for the month (euro basis: 5.9%) and stood at 141.9 points (euro basis: 138.0 points).

Source: www.hwwi.org