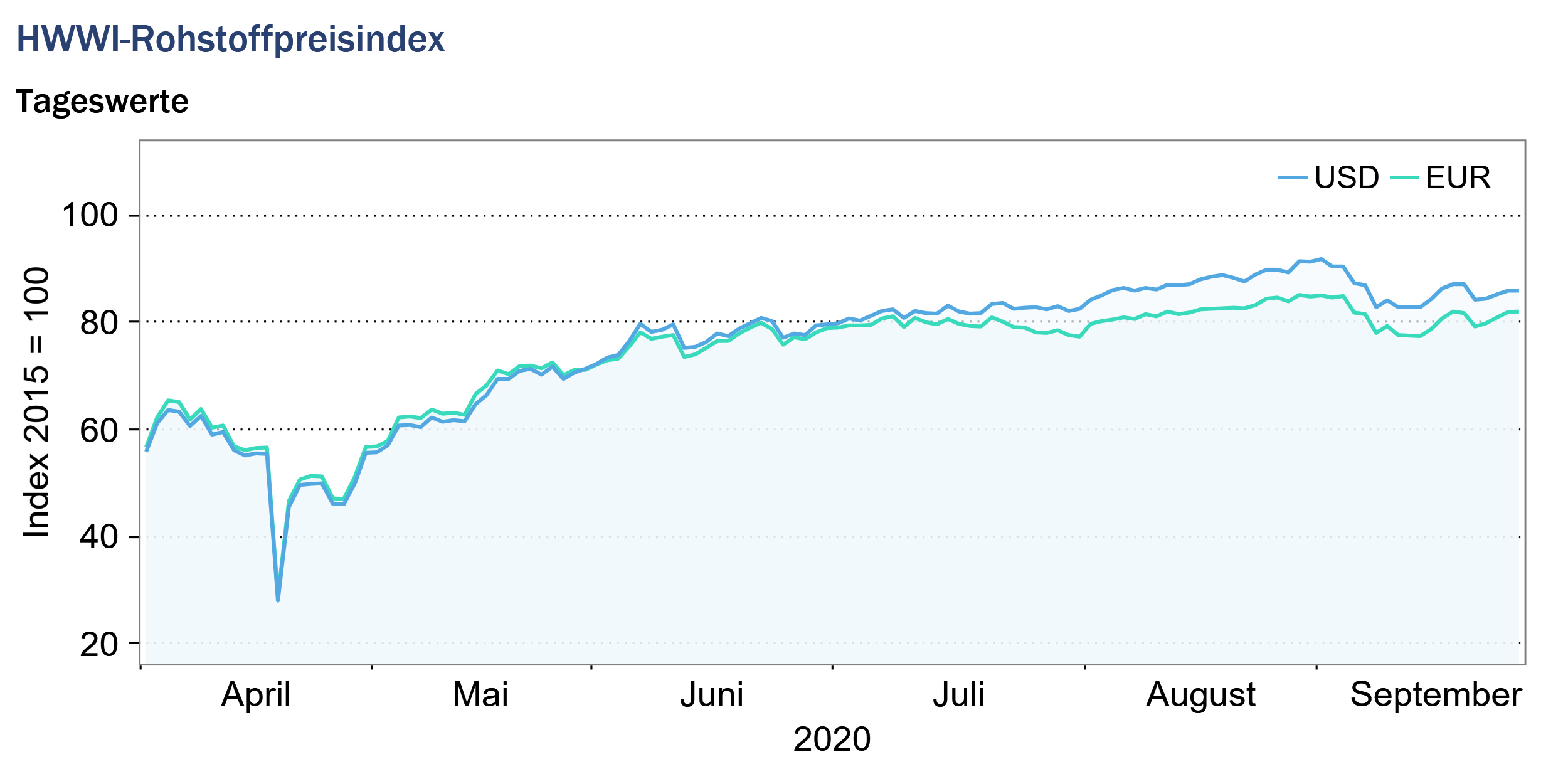

HWWI commodity price index falls in September

- HWWI overall index falls by 2.0% (US dollar basis)

- Crude oil prices fall by 6.5%

- Prices for food and beverages increase by 6.2%

(Hamburg, October 2, 2020) In September, the worldwide increase in new corona infections again increased the uncertainty on the international raw material markets. The HWWI raw material price index did not continue its upward trend and thus reflected the development of crude oil prices. Growing fears of a renewed lockdown and thus a further slump in demand for crude oil caused prices on the crude oil markets to fall. On the markets for industrial raw materials, the rising price trend continued in September, but was also dampened by the rising corona infection figures and the increased likelihood of further lockdown measures. By contrast, significant price increases were observed in the markets for food and beverages. Here, the rise in Chinese import demand in particular boosted prices on the grain markets.

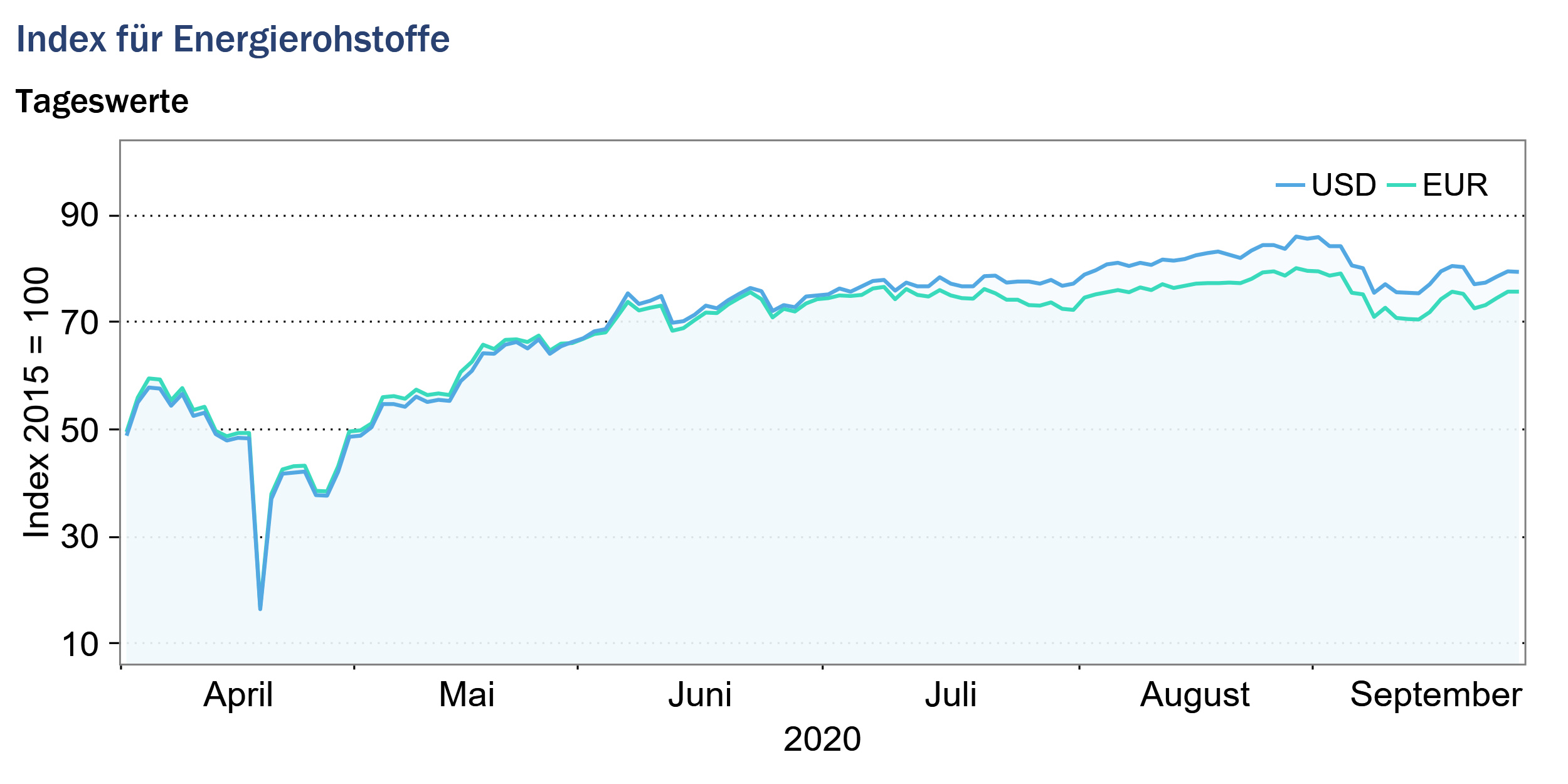

Index for energy commodities: -3.7% (Euro basis: -3.4%)

The upward trend on the crude oil markets did not continue in the first half of September and the prices of all three crude oil types included in the index fell below the USD 40 mark. The decline in prices on the crude oil markets can be explained by the worldwide increase in new infections. The renewed rise in the number of infections is leading to increasing uncertainty in the markets, which could once again slow down global economic activity, thereby reducing demand for crude oil. However, in the second half of the month, Hurricane Sally, which raged on the US Gulf Coast, caused production losses in the US crude oil industry, reducing the supply of crude oil. At times, the scarce supply drove up the price of oil. In addition, Saudi Arabia, as leader of OPEC+, tried to stabilize oil prices. Saudi Arabia urged those OPEC+ members who did not adhere to the agreed supply cuts in recent months to produce less crude oil in the coming months in order to make up for the cuts. In mid-September, the fall in US oil stocks and the crackdown by the OPEC leadership led to rising crude oil prices again. Overall, however, crude oil prices recorded an average decline in September compared to the previous month.

Triggered by the announcement of the US energy authority EIA that US natural gas inventories were higher than expected, the price of US natural gas fell slightly in September compared with the previous month. In contrast, the European natural gas price rose on average in September compared with the previous month. The prices for Australian and South African coal rose in September. Nevertheless, the price of Australian coal in particular is still far below the price in the same month last year. Demand for Australian coal from the major importing countries Japan and South Korea, among others, is largely at a low level due to the slowdown in economic activity caused by the corona pandemic and is depressing prices.

Overall, the sub-index for energy raw materials fell by 3.7% (Euro basis: -3.4%) to 79.3 points (Euro basis: 74.6 points).

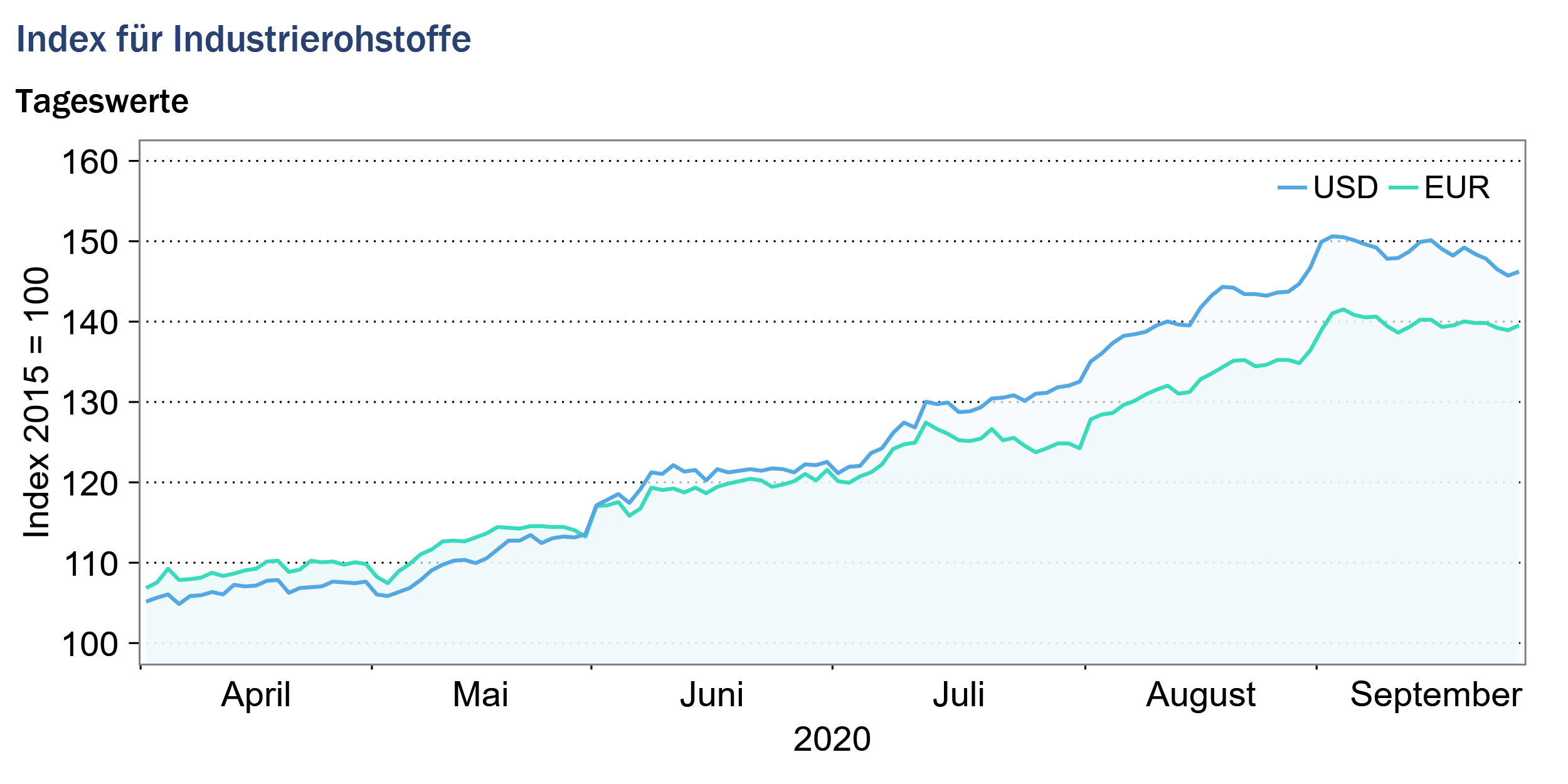

Index for industrial raw materials: +5.2% (Euro basis: +5.5%)

The sub-index for industrial raw materials is divided into the index for agricultural raw materials, the index for non-ferrous metals and the index for iron ore and steel scrap.

On the markets for industrial metals, the upward trend in prices continued in September but slowed down compared to the previous month. An exception was lead prices, which actually fell slightly on a monthly average. The dampening of the rise in industrial metal prices also reflected the increasing uncertainty on the markets, caused by the steadily rising number of new corona infections in Europe and the USA. However, the prices for iron ore and steel scrap continued to rise significantly in September, as Chinese steel production increased again in September. On the one hand, this can be explained by the Chinese economic stimulus programs, which continue to increase demand for steel. On the other hand, the Chinese national holiday on October 1 and the subsequent one-week vacation led to concerns about delivery interruptions, as many Chinese companies and also Chinese ports are closed during the holidays. Steel stocks were therefore replenished in September to avoid bottlenecks in early October. Increased demand for steel scrap and iron ore drove up prices in September.

Wool prices also declined in September. Increasing infection rates in Europe, the USA and India continued to keep demand for Australian wool low. The textile industry has suffered severely from the effects of the Corona Pandemic since the beginning of the year and has not yet been able to recover. Wool prices in September were more than 30% below the previous year’s level.

Overall, the index for industrial raw materials rose by a monthly average of 5.2% (euro basis: +5.5%) to 148.6 points (euro basis: 139.9 points).

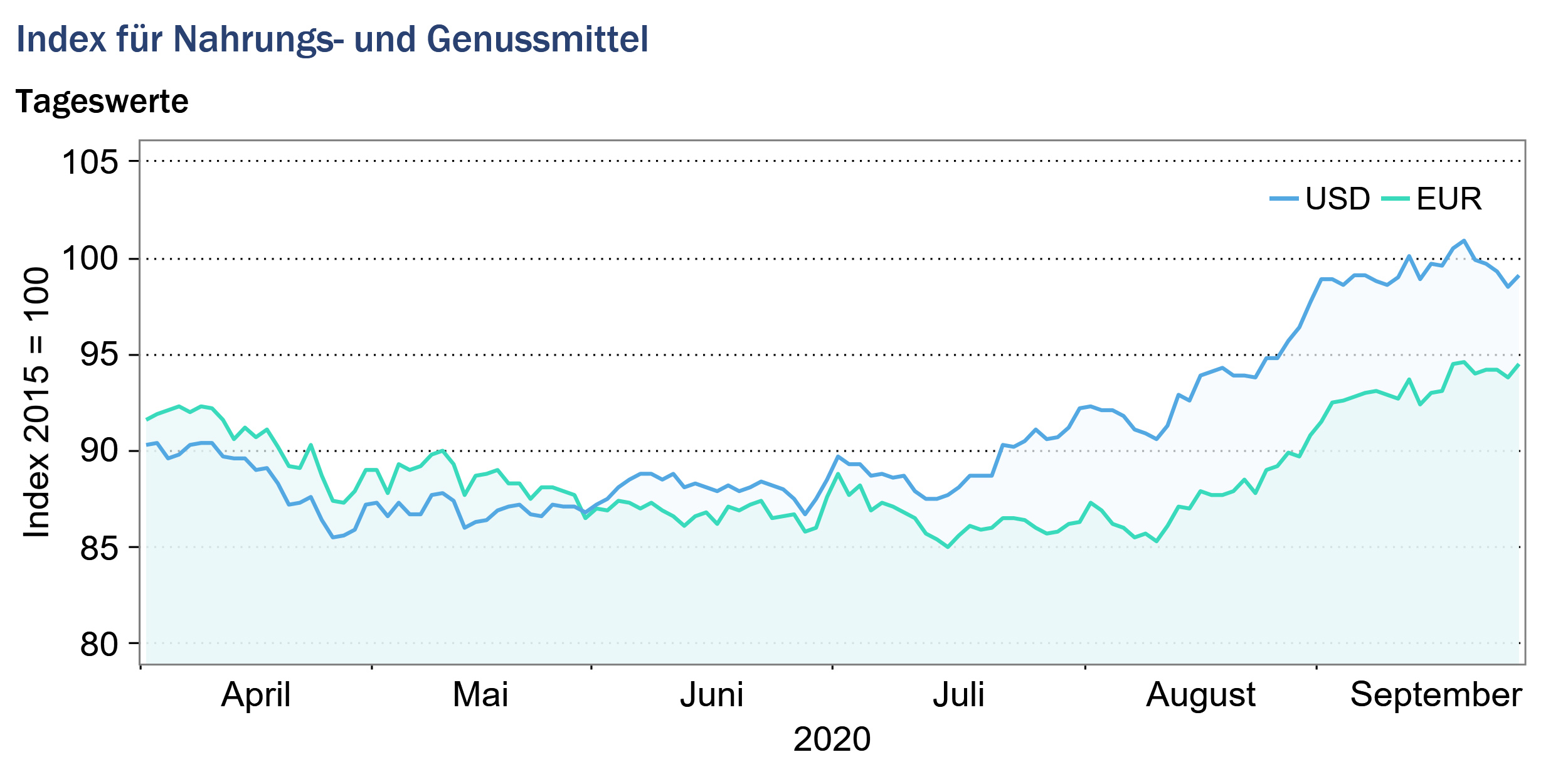

Index for food and beverages: +6.2% (Euro basis: +6.6%)

In September, prices for food and beverages rose significantly. In particular, prices for wheat, soybeans and corn rose sharply, reflecting increased demand from China. Flooding in China’s grain regions additionally led to a decline in Chinese supply and thus to increased demand for imports from China. In addition, the Chinese meat industry increasingly recovered from African swine fever, which led to an increase in Chinese demand for corn and soybeans as animal feed. Prices for vegetable oils also rose on average compared with the previous month. Since the easing of global corona restrictions, prices for vegetable oils have risen as demand for biofuel has increased again. However, the renewed introduction of lockdown measures and a further increase in crude oil prices would counteract this development in future. The price of sunflower oil rose particularly sharply in September, posting a 15% increase on the previous month. Compared with the previous year, the price of sunflower oil even rose by almost 27%. In addition to grain and vegetable oil prices, prices for coffee and cocoa also rose in September. Coffee prices rose slightly in September, as unfavorable weather prospects in Brazil clouded crop expectations for next year. The increase in cocoa prices is due to expectations of future price increases by the largest producing countries, Ghana and the Ivory Coast. The two producing countries plan to levy a premium on cocoa prices from October onwards to enable cocoa farmers to achieve higher prices. While the vast majority of commodity prices from the food and beverage segment rose, the price of sugar fell in September compared to the previous month.

Overall, the index for food and beverages rose by +6.2% on a monthly average (euro basis: +6.6%) and was quoted at 99.2 points (euro basis: 93.3 points).

Source: www.hwwi.org