HWWI raw material price index up in September

- HWWI total index rose by 4.2 % (US dollar basis)

- Upcoming heating period increases natural gas prices

- Index for food and stimulants almost unchanged

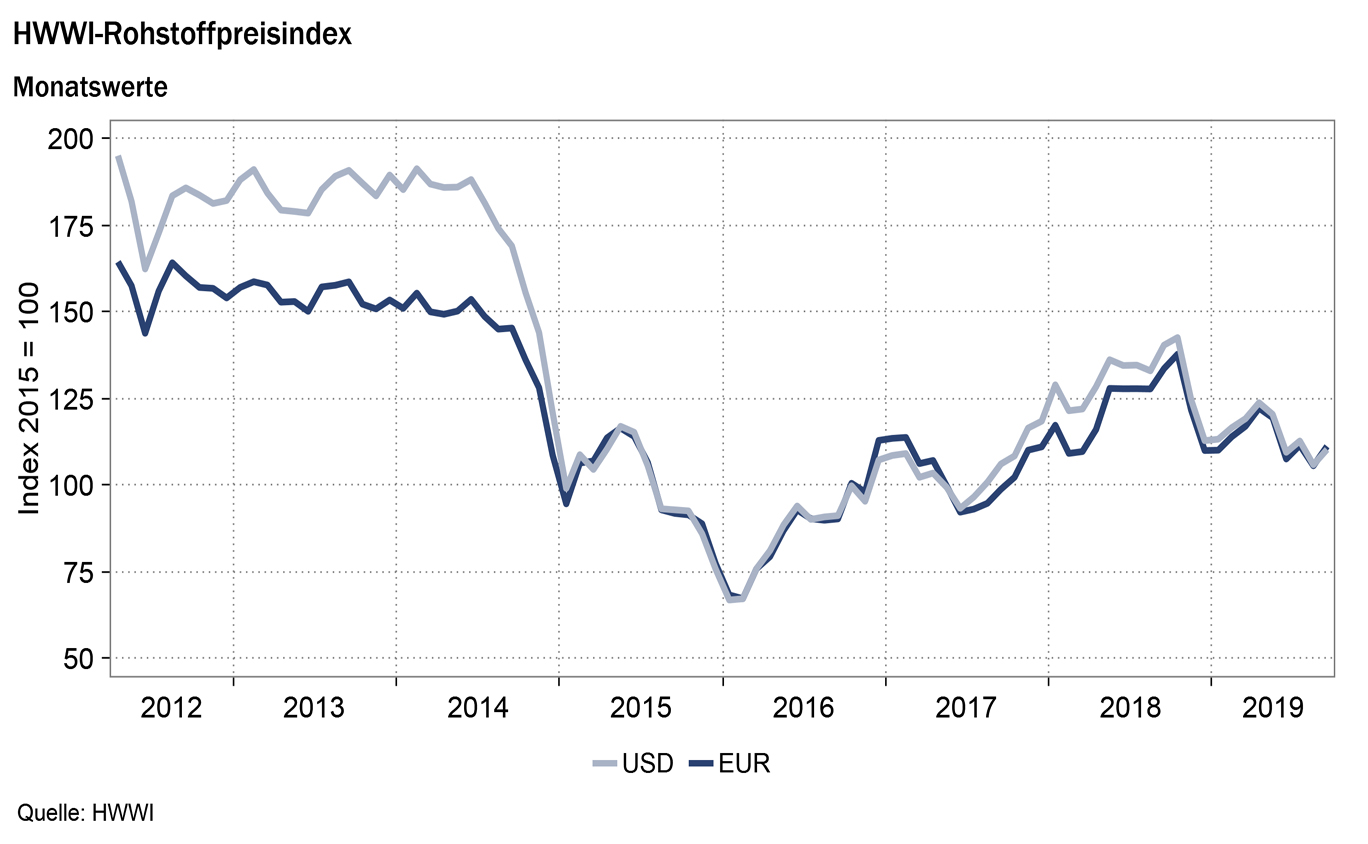

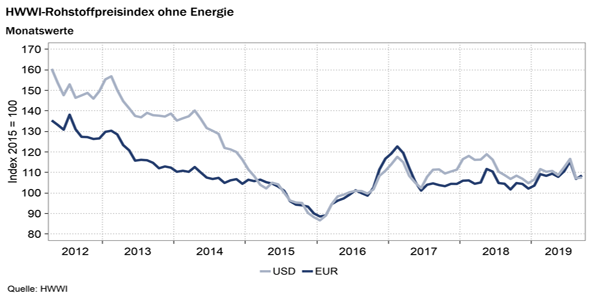

(Hamburg, 4 October 2019) In September, the HWWI commodity price index rose by an average of 4.2 % (in euros: +5.3 %) compared with the previous month and stood at 110.3 points (in euros: 111.2 points). In particular, the index for energy raw materials rose by +4.8 % (in euros: +5.9 %) due to rising crude oil and natural gas prices. On the other hand, the indices for industrial raw materials and food and stimulants remained almost at the level of the previous month, with the price development of individual raw materials continuing to be influenced by the trade conflict between the USA and China. The index for industrial raw materials rose moderately by 0.6% (in euros: +1.7%). The index for food and stimulants in US dollars showed no change compared with the previous month. In euro terms, the index for food and stimulants rose by 1.1 %, as the currently falling euro exchange rate makes raw materials more expensive for European importers. The index excluding energy commodities rose by 0.4 % (in euros: +0.3 %).

Index for energy raw materials: +4.8 % (in euro: +5.9 %)

The monthly average price of crude oil rose by 4.0% (in euros: +5.2%) to 60.19 US dollars (in euros: 54.70) per barrel. Following a drone attack on a crude oil refinery in Saudi Arabia in the middle of the month, prices had risen sharply at times. All reference grades listed in the index were similarly affected by the price increase on a monthly average. As there were no further attacks and the crude oil market is characterised by overcapacities, prices fell in the second half of the month and at the end of the month were quoted at the same level as before the attack. The price of European Brent crude oil rose most sharply. The price of Brent rose by 4.5 % (in euros: 5.6 %). Dubai crude oil from the Middle East rose by +3.9% (in euros: +5.0%), the second strongest. By contrast, the price of the US crude oil West Texas Intermediate (WTI) rose by only +3.8% (in euros: +4.9%).

The average price of natural gas rose by 11.9% (in euros: +13.1%). In the United Kingdom, a drop in temperature at the beginning of the month caused the European natural gas price to rise by 6.8% (in euros: +8.0%). In the USA, the price of natural gas rose by 15.5 % (in euros: +16.8 %) after the price in the previous month had fallen to its lowest level since May 2016. Coal prices, on the other hand, hardly changed. The monthly average price of coal fell (in euros: rose) by 0.6 % (in euros: +0.5 %). Overall, the index for energy raw materials rose by 4.8 % (in euros: +5.9 %) to 110.8 points (in euros: 111.7 points).

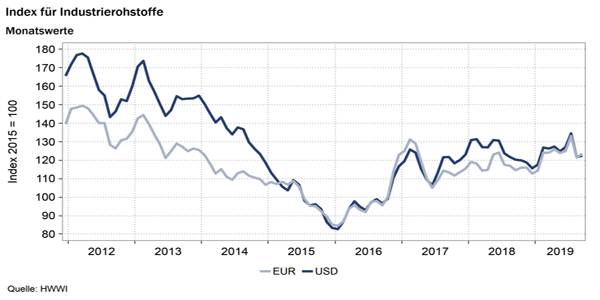

Index for industrial raw materials: +0.6 % (in Euro: +1.7 %)

The index for industrial raw materials is subdivided into the index for agricultural raw materials, the index for non-ferrous metals and the index for iron ore and steel scrap. The index for agricultural raw materials rose by +3.2% (in euro: +4.3%). Australian wool recorded its seventh consecutive monthly average decline. As a result of the trade conflict, Chinese clothing manufacturers are having difficulties selling their products in the USA and have therefore reduced imports of wool. By contrast, the price of sawn timber rose by 10.5 % (in euros: +11.7 %).

The index for base metals rose by 2.2% (+3.3% in euro terms). As in the previous month, nickel in particular recorded a strong price increase of 12.7% (in euros: +13.9%). After the world’s largest nickel producer Indonesia confirmed that it would bring forward the export ban originally planned for 2022 to 2020, demand from China in particular rose sharply. A rising price trend was observed for all non-ferrous metals. The most moderate price increase was recorded for aluminium. The price of aluminium rose by 0.5 % (in euros: +1.6 %). The price of copper rose slightly by 0.7% (in euros: +1.8%). Lead prices rose by 1.3% (in euros: +2.4%), tin prices rose by 1.7% (in euros: +2.9%) and zinc prices rose by 2.0% (in euros: +3.1%). As China cut its steel production in September, prices for iron ore and steel scrap fell by 2.7% (in euros: -1.6%). Overall, the index for industrial raw materials rose slightly by 0.6% (in euros: +1.7%) to 122.4 points (in euros: 123.5 points).

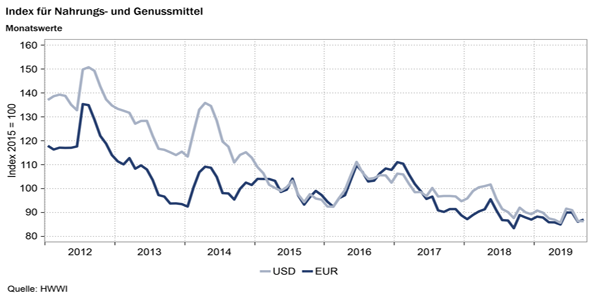

Index for food and beverages: ±0.0 % (in euro: +1.1 %)

Grain prices are influenced by the ongoing trade conflict between the US and China, as reciprocal tariffs increase import prices and lead to falling demand. The barley price continued its downward trend from August and fell by 13.7% (in euros: -12.7%). Corn and wheat prices also fell. The corn price fell by 3.8% (in euro: -2.7%). Wheat fell by 1.3% (in euro: -0.2%). The cocoa price, on the other hand, rose by 4.9 % (in euro: +6.1 %) despite good prospects for the harvest beginning in October. Possibly higher guaranteed prices for farmers in the largest cocoa exporting country, Ivory Coast, will play a role here. The coffee price rose slightly by 1.7 % (in euros: +2.8 %). As a result of these contrary price developments, the index for food and stimulants overall remained at the level of the previous month (in euros: +1.1 %) and remained unchanged at 86.3 points (in euros: 87.0 points).